5 Steps to Mastering Debt Management Once and For All

Mastering debt management involves not only paying off existing balances but also creating a sustainable financial plan to prevent future debt. Key steps include understanding your debt situation, creating a realistic budget, prioritizing debt repayment using methods like avalanche or snowball, exploring debt consolidation options, and seeking professional advice when necessary. By taking these strategic actions, you can reduce financial stress and work towards achieving long-term financial freedom.

Debt can feel like that unwelcome guest who refuses to leave the party. It clings on, demands attention, and often overstays its welcome. If you've ever found yourself staring at a stack of bills wondering how you got here, you're not alone. Most of us have faced financial hurdles at some point, and mastering debt management is a journey, not a sprint. The good news? With a little strategy and some determination, you can take control of your debt and pave the way for financial freedom.

Let's delve into the nitty-gritty of debt management. This isn't just about paying off what you owe; it's about crafting a sustainable financial plan that keeps debt from creeping back into your life. Here are five steps to help you on your path to mastering debt management once and for all.

Understand Your Debt Situation

Before you can tackle your debt, you need to know exactly what you're dealing with. Start by making a list of all your existing debts. Include everything from credit card balances and student loans to personal loans and any other outstanding obligations. Note down the interest rates, minimum payments, and due dates for each. This will give you a clear picture of your financial landscape.

For many, this first step is a revelation. As financial expert Dave Ramsey often points out, "You can’t manage what you don’t measure." Knowing the full extent of your debt is crucial to formulating a strategy. Consider using a spreadsheet or a dedicated financial app to track your debts. Seeing everything laid out in black and white can be a powerful motivator.

Create a Realistic Budget

With your debt inventory complete, it's time to create a budget. This isn't about restricting yourself but rather understanding where your money is going and how you can direct it more effectively. Start by listing your income and essential expenses like rent, utilities, groceries, and transportation. Be honest about your spending habits, and identify areas where you can cut back.

A realistic budget should also account for irregular expenses like annual insurance premiums or holiday gifts. According to a survey by NerdWallet, many people underestimate these costs, which can lead to surprise debt accumulation. Set aside a small amount each month for these expenses to avoid being caught off guard.

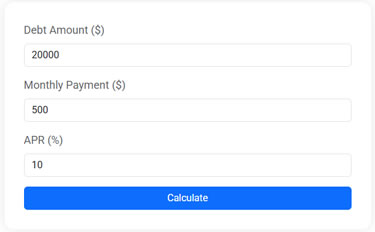

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Prioritize Debt Repayment

With a budget in hand, it's time to tackle your debt head-on. There are two popular strategies for debt repayment: the avalanche method and the snowball method. The avalanche method involves paying off debts with the highest interest rates first, which can save you money in the long run. The snowball method, on the other hand, focuses on paying off the smallest debts first to build momentum and motivation.

Both methods have their merits. As financial advisor Jane Smith explains, "The best method is the one you'll stick with." Choose the strategy that resonates with you and fits your financial situation. Whichever path you take, ensure you're making at least the minimum payments on all debts to avoid late fees and damage to your credit score.

Explore Debt Consolidation Options

For some, debt consolidation can be a game-changer. This involves combining multiple debts into a single loan, often with a lower interest rate. It simplifies the repayment process and can potentially save you money in interest payments. Options for debt consolidation include personal loans, balance transfer credit cards, and home equity loans.

However, consolidation isn't a one-size-fits-all solution. It's important to weigh the pros and cons. For example, while a balance transfer card might offer 0% interest for an introductory period, it could revert to a high rate if not paid off in time. As CNBC reports, "Debt consolidation can be beneficial, but it requires discipline." Make sure you understand the terms and conditions before proceeding.

Seek Professional Advice When Necessary

Sometimes, despite your best efforts, managing debt can feel overwhelming. In such cases, seeking professional advice can be invaluable. A certified financial planner or a credit counselor can provide personalized guidance based on your situation. They can help you explore options like debt management plans or even negotiating with creditors.

Remember, seeking help isn't a sign of failure. It's a proactive step towards regaining control of your finances. As the National Foundation for Credit Counseling suggests, "A trusted advisor can offer insights and solutions you might not have considered." Don't hesitate to reach out if you need assistance.

By taking these strategic steps, you can reduce financial stress and work towards achieving long-term financial freedom. The road to mastering debt management isn't always easy, but with patience and perseverance, you can reclaim your financial future. So, take a deep breath, roll up your sleeves, and start tackling your debt head-on. You've got this!