The Art of Negotiation: How to Lower Your Debt

Debt negotiation can be a powerful tool for achieving financial freedom by potentially lowering payments, reducing interest rates, or fully resolving debt. Start by understanding your debt situation, researching negotiation strategies, and initiating professional, empathetic conversations with creditors. Follow through on new terms to demonstrate reliability, and use progress tracking to stay motivated and improve your financial health.

Debt can feel like a heavyweight tethered to your ankle, slowing down your journey toward financial freedom. It's a common burden, yet many people are unaware of the power they hold to alleviate this pressure. Enter the art of negotiation—a skill that can transform the way you handle debt. While it might seem intimidating to confront your creditors, negotiating your debt can lead to lower payments, reduced interest rates, or even complete resolution of your debt. It's not just about saving money; it's about gaining control over your financial future.

The key to successful negotiation lies in preparation and communication. By understanding your debt situation, researching effective strategies, and engaging in empathetic conversations with creditors, you can pave the way for better financial health. Let's dive into how you can master this art and start seeing real changes in your financial landscape.

Understanding Your Debt Situation

Before you can negotiate effectively, you need a clear picture of your financial situation. This means pulling out the paperwork and getting familiar with the details of your debt. Start by listing all your debts, including credit card balances, student loans, medical bills, and any other obligations. Note down the interest rates, minimum payments, and due dates for each.

Understanding the nature of your debts helps you prioritize which ones to tackle first. For instance, a high-interest credit card debt might take precedence over a low-interest student loan. As financial advisor Jane Smith suggests, "Knowing your debt inside and out is your first weapon in negotiation. It empowers you to make informed decisions that creditors can't easily refute."

Researching Negotiation Strategies

Once you're familiar with your debt, it's time to research common negotiation strategies. Each type of debt may require a different approach. For credit card debts, you might negotiate for a lower interest rate or a payment plan that fits your budget. On the other hand, medical debts often have more flexibility, and you may be able to settle for a reduced lump sum payment.

It's also valuable to learn the language of negotiation. Terms like "hardship plan," "debt settlement," and "forbearance" can open doors to more beneficial arrangements. According to a CNBC report, many consumers are unaware that creditors often have specific programs designed to aid those in financial distress. Understanding these options can give you leverage in your discussions.

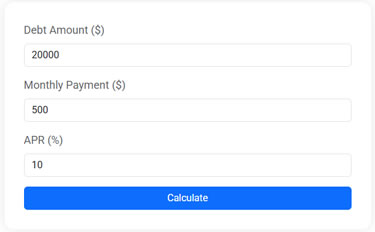

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Initiating Conversations with Creditors

When you're ready to start negotiations, approach your creditors with professionalism and empathy. Remember, the person on the other end of the line is just doing their job, so a polite and respectful tone can go a long way. Begin by explaining your situation honestly and expressing your desire to find a solution that benefits both parties.

It's crucial to be clear about what you're asking for. Whether it's a reduction in interest rates, a waiver of late fees, or a temporary payment plan, be specific. According to debt expert David Ramsey, "Clarity in your request shows creditors that you're serious and have thought through your proposal." Be prepared for some back-and-forth negotiation, and don't be afraid to ask for time to consider their offers.

Following Through on New Terms

Once you've reached an agreement, it's vital to follow through on the new terms. This not only builds your credibility but also improves your financial standing over time. Make payments on time, and if possible, pay more than the minimum to reduce your debt faster.

Keep all documentation related to the agreement, including emails and letters. This ensures you have a record in case there are discrepancies later on. As personal finance blogger Emily Johnson advises, "Sticking to your commitments shows creditors you're trustworthy, which can make future negotiations easier if needed."

Tracking Progress and Staying Motivated

Tracking your progress is essential to maintaining motivation and ensuring you're on the right path. Create a visual representation of your debt reduction, such as a chart or graph, and update it regularly. This tangible evidence of your progress can be incredibly motivating.

Celebrate small victories along the way. Whether it's paying off a credit card or reaching a new milestone in your savings, acknowledging these achievements can boost your morale. Remember, the road to financial freedom is a marathon, not a sprint. As you see your debt decrease, your confidence in managing your finances will grow.

Embracing Financial Education

Negotiating your debt is just one aspect of financial health. To continue making informed decisions, embrace financial education as a lifelong journey. Seek out resources like books, podcasts, and online courses to deepen your understanding of personal finance.

By staying informed, you'll be better equipped to handle future financial challenges and opportunities. As financial educator Suze Orman famously states, "The more you know about how money works, the better equipped you are to make your money work for you."

In conclusion, mastering the art of negotiation can dramatically shift your financial picture. By understanding your debt, researching strategies, communicating effectively, and following through, you'll not only lower your debt but also gain confidence and control over your financial future. Remember, every step toward managing your debt is a step toward financial freedom.