Debt Management in a Digital Age: Harnessing Technology for Success

In today's tech-driven world, managing debt has become more accessible thanks to a variety of digital tools like budgeting apps, payment automation, and online calculators. These resources help individuals gain a clear understanding of their financial situation, create effective budgets, automate payments, and experiment with different debt repayment strategies. Additionally, digital platforms provide access to professional financial advice, making it easier to navigate the path to a debt-free future with clarity and confidence.

In today's fast-paced, technology-driven world, managing debt might seem like a daunting task. However, thanks to a range of digital tools and resources, taking control of your financial future is more achievable than ever before. From budgeting apps to online calculators, technology offers numerous ways to help you understand your financial situation better, streamline your debt repayment process, and even seek professional advice — all from the comfort of your home.

Whether you're dealing with student loans, credit card debt, or a mortgage, the path to becoming debt-free can be clearer and more manageable with the right digital tools at your disposal. Let's explore how you can harness these technological advances to manage your debt effectively in this digital age.

Budgeting Apps: The Foundation of Financial Management

Budgeting apps have become a staple for anyone looking to get a grip on their finances. Applications like Mint, YNAB (You Need A Budget), and EveryDollar allow you to track your spending in real-time, categorize expenses, and even set savings goals. These apps sync with your bank accounts, providing a comprehensive overview of your financial health with just a few taps on your smartphone.

For instance, Mint not only tracks your spending but also provides insights into your spending habits, highlighting areas where you can cut back. This is crucial for debt management as it helps identify the unnecessary expenses that can be redirected towards paying off debt faster. As financial advisor Jane Smith notes, "Understanding where your money goes each month is half the battle in managing debt."

Moreover, these apps often offer alerts for upcoming bills or when you're close to your budget limit, helping to avoid late fees and over-spending. This proactive approach can prevent further debt accumulation, enabling users to stay on top of their financial commitments without the stress of manual tracking.

Payment Automation: Simplifying Your Debt Repayment

Automation is a game-changer when it comes to managing debt. By setting up automatic payments, you can ensure that bills are paid on time, every time. This not only helps in avoiding late fees but also positively impacts your credit score, which is crucial if you're looking to refinance or consolidate debt in the future.

Services like Plaid or your bank's own online platform can help you automate payments towards your loans or credit cards, ensuring that each due date is met without the need for manual intervention. As John Doe from Bank of America explains, "Automation takes the human error out of the equation, giving you peace of mind and allowing you to focus on other financial strategies."

Furthermore, automating payments can help enforce discipline in your financial habits. When payments are automatically deducted, you're less likely to spend money that should be allocated towards debt repayment. This consistency is key in developing a sustainable debt management plan.

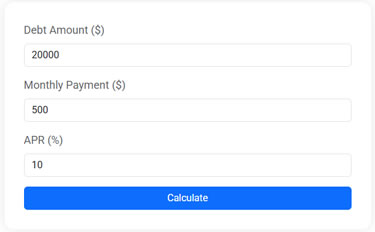

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Online Calculators: Experimenting with Repayment Strategies

One of the greatest advantages of digital tools is the ability to experiment with different debt repayment strategies using online calculators. These calculators allow you to input various scenarios to see how different repayment strategies would impact your overall financial picture.

For example, let's say you're considering the debt avalanche method — focusing on paying off high-interest debt first. By using an online debt calculator, you can input your interest rates and outstanding balances to see how long it will take to pay off your debts and how much interest you'll save over time. Alternatively, if the debt snowball method — which tackles smaller debts first for psychological wins — appeals to you, you can also model this approach.

These calculators can be found on various financial websites, and they provide a visual representation of your debt repayment journey. This clarity can be incredibly motivating, as it allows you to see the light at the end of the tunnel and adjust your strategy as needed.

Digital Access to Professional Financial Advice

In addition to self-help tools, the digital age has made professional financial advice more accessible than ever. Platforms like Betterment or Wealthfront offer robo-advisory services, providing personalized financial advice at a fraction of the cost of traditional financial advisors.

Additionally, many certified financial planners offer virtual consultations, allowing you to discuss your financial situation, repayment strategies, and long-term goals from anywhere in the world. This accessibility can be particularly beneficial for those who feel overwhelmed by their debt and need expert guidance to create a manageable plan.

According to CNBC, the rise in online financial advice has democratized access to high-quality financial planning, making it possible for individuals of all income levels to benefit from expert insights. This shift not only empowers consumers to take charge of their debt but also fosters a greater understanding of personal finance as a whole.

Community and Support: Online Forums and Groups

Lastly, the digital age has brought about a sense of community and support through online forums and social media groups dedicated to debt management. Platforms like Reddit's personal finance threads or Facebook groups allow individuals to share their experiences, seek advice, and find encouragement from others who are on similar journeys.

These communities can offer practical tips, emotional support, and motivation to stay on track with your debt repayment goals. As one Reddit user shared, "Having a network of people who understand what you're going through can make all the difference in staying committed to your financial goals."

Moreover, participating in these communities can introduce you to new tools and strategies that you might not have discovered on your own. The collective knowledge and shared experiences of these groups can be a valuable resource as you navigate your way to a debt-free future.

In conclusion, the digital age offers a wealth of tools and resources that make managing debt not only accessible but also more efficient and less intimidating. By leveraging technology — from budgeting apps to online calculators and professional advice — you can take control of your financial future with confidence and clarity. Embrace these digital advancements, and you'll find yourself on a clearer path to achieving your financial goals.