Expert Insights on Reducing Your Taxable Income

To reduce your tax bill and keep more of your income, consider maximizing retirement contributions, utilizing Health Savings Accounts (HSAs), leveraging tax credits, making charitable contributions, and optimizing your tax filing status. Each strategy offers unique benefits, such as tax deductions, credits, or lower tax rates, which can significantly decrease your taxable income. Always consult with a tax professional to ensure these methods align with your personal financial goals and circumstances.

Reducing your taxable income might sound like a daunting task, akin to navigating a maze without a map. But it doesn’t have to be. With a few strategic moves, you can lower your tax bill and keep more of your hard-earned money. From maximizing retirement contributions to utilizing Health Savings Accounts (HSAs), there are several ways to tackle your tax obligations more smartly. Whether you're a seasoned taxpayer or new to the world of deductions and credits, these insights can help you make informed decisions. And remember, while we’re diving into these strategies, consulting with a tax professional can tailor these methods to fit your unique financial situation.

Maximizing Retirement Contributions

One of the most effective ways to reduce taxable income is by contributing to retirement accounts like a 401(k) or an IRA. These contributions not only bolster your retirement savings but also provide immediate tax benefits. For example, in 2023, the IRS allows individuals under 50 to contribute up to $22,500 to a 401(k) and $6,500 to an IRA. These contributions reduce your taxable income dollar-for-dollar. Imagine you’re earning $70,000 a year; maxing out your 401(k) could drop your taxable income to $47,500, potentially moving you to a lower tax bracket. As financial planner Alex Johnson notes, "It’s like getting a discount on your retirement savings. Plus, your future self will thank you."

Utilizing Health Savings Accounts (HSAs)

Health Savings Accounts offer a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses aren’t taxed. If you’re enrolled in a high-deductible health plan, an HSA can be a powerful tool. For 2023, you can contribute up to $3,850 for individual coverage or $7,750 for family coverage. Let’s say you contribute $3,000 to your HSA this year; that’s $3,000 less in taxable income. Plus, if you don’t use the funds, they roll over year-to-year and can even be used in retirement. As HSA expert Linda Martinez often says, "Think of your HSA as a future-proof investment in both your health and financial well-being."

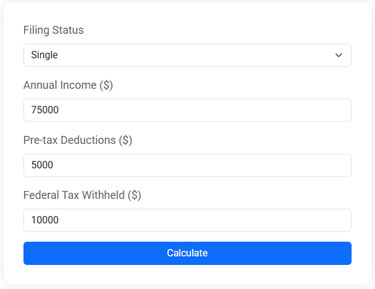

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Leveraging Tax Credits

While deductions reduce your taxable income, tax credits cut your tax bill directly. Some of the most beneficial credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and education credits like the American Opportunity Credit. For example, the EITC is designed for low- to moderate-income earners and can be worth up to $6,935 in 2023, depending on your income and family size. Tax credits can significantly lower your tax liability, sometimes even resulting in a refund. As noted by tax expert Sarah Collins, "Credits are more powerful than deductions because they reduce your tax bill dollar-for-dollar. It’s like getting a direct paydown on your taxes."

Making Charitable Contributions

Giving back not only feels good but can also be good for your tax situation. Charitable contributions to qualified organizations are tax-deductible if you itemize deductions. This could include cash donations, goods, or even volunteering expenses. For instance, donating $1,000 to your favorite local charity would reduce your taxable income by that amount. Just remember to keep receipts and documentation for any donations. Financial advisor Tom Reyes advises, "Align your charitable giving with your values, and you’ll find it’s a rewarding way to reduce your taxable income while supporting causes you care about."

Optimizing Your Tax Filing Status

Your tax filing status can significantly impact your tax liability. The options—single, married filing jointly, married filing separately, head of household, or qualifying widow(er)—each have different tax brackets and standard deductions. For instance, married couples filing jointly often benefit from lower tax rates and a higher standard deduction compared to filing separately. However, in some cases, such as when one spouse has significant medical expenses or miscellaneous deductions, filing separately might be advantageous. As tax advisor Jason Lee explains, "Choosing the right filing status isn’t just a checkbox on your tax form. It’s a strategic decision that can influence your tax outcome."

In the end, reducing your taxable income involves understanding and utilizing available strategies to your advantage. Each method offers unique benefits, from immediate tax deductions to future savings growth. However, as everyone’s financial situation is different, it’s crucial to tailor these strategies to your specific circumstances, ideally with guidance from a tax professional. By approaching your tax planning thoughtfully, you can achieve a more favorable tax outcome while setting yourself up for long-term financial success.