How to Create a Budget That Works for You

Budgeting is often misunderstood as restrictive, but it's essentially a plan that aligns your spending with your priorities, whether you're saving for a goal or managing daily expenses. To create an effective budget, start by understanding your financial picture, set clear and realistic goals, choose a budgeting method that suits your lifestyle, and diligently track and adjust your spending. By doing so, budgeting becomes a flexible tool that empowers and enhances your financial journey, helping you achieve peace and prosperity.

When people hear the word "budget," they often picture a financial straitjacket, squeezing the joy out of their spending habits. But let's flip that script. A budget is less about restriction and more about freedom. Imagine it as a trusty road map that guides you toward your financial goals, whether that's saving for a dream vacation, paying off debt, or simply ensuring you don't stress over rent at the end of the month. Crafting a budget that works for you can transform it from a dreaded chore into a powerful tool that aligns your spending with your values and priorities.

In this article, we'll explore how to create a budget that fits your lifestyle like a glove. It starts with understanding your current financial picture, setting clear and achievable goals, choosing a budgeting method that feels right, and continuously tracking and tweaking your spending. Let's dive into the details and unlock the potential of a budget that empowers rather than stifles.

Understanding Your Financial Picture

Before you can create a budget that works for you, it's crucial to get a clear view of your current financial landscape. Start by gathering all your financial information in one place. This includes your income sources, monthly expenses, debts, and any other financial obligations. Use bank statements, pay stubs, and receipts to paint a full picture. As financial expert Dave Ramsey often suggests, "You need to know where your money is going before you can tell it where to go."

Once you have your financial data, categorize your spending. Common categories include housing, food, transportation, entertainment, and savings. Don't forget to account for irregular expenses, like annual insurance premiums or holiday gifts. By understanding where your money currently flows, you can begin to see areas where you might be overspending or opportunities for saving.

For example, you might discover that your monthly coffee shop visits are costing you more than you realized. While it's not about eliminating all joy from your life, recognizing these patterns allows you to make informed decisions about where you might want to cut back. Think of this stage as taking stock before setting sail on your financial journey.

Setting Clear and Realistic Goals

With a comprehensive view of your finances in hand, the next step is setting goals that will guide your budgeting efforts. Goals can be short-term, like saving for a new laptop, or long-term, such as building a retirement fund. The key is to ensure they are specific, measurable, achievable, relevant, and time-bound—often abbreviated as SMART goals.

For instance, instead of setting a vague goal like "save more money," aim for something specific: "Save $500 over the next three months for a summer road trip." This clarity not only motivates but provides a concrete target to aim for. As personal finance guru Suze Orman advises, "When you have a goal, it changes how you see and use your money."

Consider your priorities when setting these goals. What truly matters to you? If travel is a passion, perhaps you allocate more to a travel fund. If debt is weighing you down, focus on an aggressive repayment plan. Your budget should reflect your life’s aspirations, not just financial obligations.

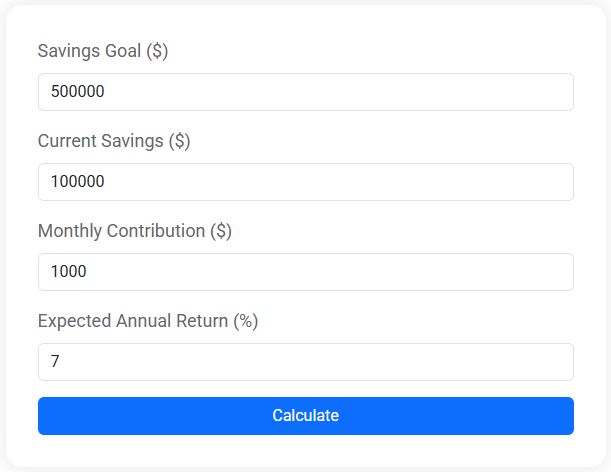

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Choosing a Budgeting Method That Fits

Budgeting isn't one-size-fits-all, and that's a good thing. There are several popular budgeting methods, and the best one is the one that aligns with your personal style and lifestyle. Some people thrive on detailed spreadsheets, while others prefer hands-on methods like cash envelopes.

The 50/30/20 rule, popularized by Senator Elizabeth Warren, is a straightforward method where you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It's simple and flexible, making it a favorite for many. Alternatively, the zero-based budget requires you to allocate every dollar of your income to expenses, savings, or debt, ensuring you account for every penny.

If you're tech-savvy, consider using budgeting apps like YNAB (You Need a Budget) or Mint. These digital tools can simplify the process by automatically tracking your expenses and providing insights into your spending habits. Experiment with different methods until you find one that feels intuitive and effective for you.

Tracking and Adjusting Your Spending

Creating a budget is only the beginning—sticking to it is where the real work begins. Tracking your spending is crucial to ensure you're adhering to your plan. The good news is, technology makes this easier than ever. Apps and software can link directly to your bank accounts, categorizing expenses and providing real-time updates on your financial status.

Regularly review your budget and spending to ensure you're on track. If you find you're consistently overspending in certain areas, it might be time to adjust your budget. Flexibility is key. Life happens, and your budget should be able to adapt to changes, whether that's an unexpected car repair or a surprise bonus at work.

For example, if you receive a raise, decide in advance how you'll allocate that extra income. Perhaps you'll increase your savings rate or finally start that side project you've been dreaming about. As financial planner Carl Richards puts it, "A budget is about making choices, and being intentional about how you spend your money."

Embracing Budgeting as a Lifestyle

Ultimately, budgeting is not a one-time task but a continuous process that evolves with your life. It's about creating a sustainable financial plan that supports your goals and reflects your values. With practice, budgeting becomes second nature, guiding your financial decisions without feeling like a chore.

Think of your budget as a living document—something that grows and adapts with you. As your priorities shift and your financial situation changes, so too should your budget. It's a tool that, when used effectively, can bring immense peace of mind and set the stage for long-term prosperity.

Remember, a budget is not about perfection. It's about progress. With each adjustment and every goal met, you're not just managing money—you're crafting the life you want to live. Embrace budgeting as a journey, not a destination, and you'll find it becomes an empowering part of your financial toolkit.