Smart Shopping Strategies: How to Save Money on Everyday Purchases

In today's fast-paced world, smart shopping strategies like planning ahead with a list, using coupons and discounts, and taking advantage of loyalty programs can help save money without compromising quality. Comparing prices using tools like Google Shopping and buying in bulk wisely also contribute to maximizing savings. By adopting these tactics, you can make intentional financial choices that align with your goals, ensuring a healthier financial future.

In today's fast-paced world, where every dollar counts more than ever, being a savvy shopper is not just a skill—it's practically a superpower. We all know the feeling of watching prices creep up on our everyday essentials, from groceries to household goods. But here’s the good news: with a little planning and some insider tactics, you can stretch your budget further without sacrificing quality. Think of this as your personal cheat sheet to smart shopping, with strategies that promise to lighten your financial load and make every purchase count.

Shopping smart isn’t about penny-pinching or denying yourself the things you love. It’s about making intentional choices that align with your financial goals. It’s about being proactive rather than reactive, ensuring that your hard-earned money is spent wisely. So, let’s dive in and explore some effective strategies that can transform your everyday shopping habits and help you achieve a healthier financial future.

Plan Ahead with a List

One of the simplest yet most effective ways to save money is to plan your shopping trips in advance. Creating a shopping list helps you stay focused on the essentials and avoids those tempting impulse buys that can quickly add up. According to a study published in the Journal of Consumer Research, shoppers who use lists spend significantly less than those who don't. This is because a list not only keeps you on track but also reduces the likelihood of forgetting items, which can lead to unnecessary return trips and additional purchases.

To make the most of your list, categorize it by sections of the store or by priority. This method saves you time as well as money. It’s also beneficial to review your pantry and fridge before heading out—this way, you won’t buy duplicates of items you already have. And remember, sticking to your list is key, so if you see something that's not on it, make a mental note to include it next time if it's truly necessary.

Utilize Coupons and Discounts

Coupons and discounts are like free money waiting to be claimed. In the digital age, accessing these savings is easier than ever. Websites and apps like Honey, RetailMeNot, and Coupons.com offer a treasure trove of deals just a click away. According to CNBC, the average shopper can save up to $1,000 a year simply by using coupons effectively.

Timing is everything when it comes to discounts. Keep an eye on sales cycles, and don't shy away from buying out-of-season items—this can lead to significant savings. For instance, purchasing winter clothing at the end of the season can save you up to 70%. Additionally, many retailers offer digital coupons through their apps, which can be loaded directly onto your store loyalty card, making it easier than ever to save without needing to clip paper coupons.

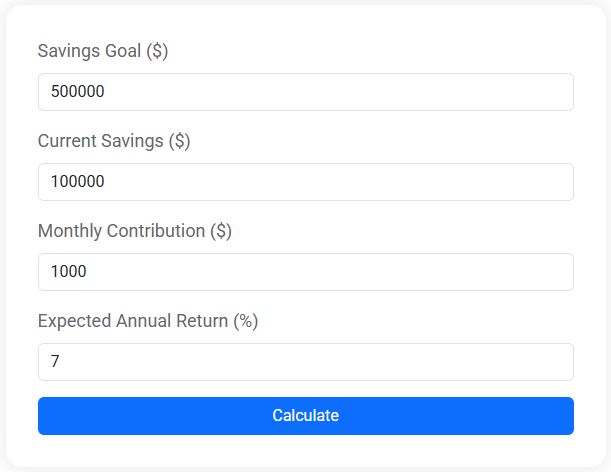

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Take Advantage of Loyalty Programs

Loyalty programs are a fantastic way to earn rewards for the shopping you’re already doing. These programs often provide exclusive discounts, early access to sales, and points that can be redeemed for future purchases. For example, if you frequently shop at a particular grocery store, joining their loyalty program can result in discounts on items you regularly buy, which adds up over time.

Many coffee shops, clothing retailers, and even gas stations offer these types of programs. Take Starbucks, for instance—their rewards program offers free drinks and food after accumulating enough points. It's worth signing up for programs at places where you spend the most money and reviewing your statements to ensure you're capitalizing on all available benefits. Just remember to read the fine print, as some programs have expiration dates on points or require a minimum purchase to receive rewards.

Compare Prices Using Online Tools

With the vast amount of information available online, comparing prices has never been easier. Tools like Google Shopping, PriceGrabber, and CamelCamelCamel allow you to compare prices across multiple retailers, ensuring you get the best deal. This is particularly useful for larger purchases, where price differences can be more substantial.

An example of this in action is the purchase of electronics. Let’s say you’re in the market for a new laptop. Before making a purchase, input the model into Google Shopping to see where it’s sold and at what price. Often, you’ll find promotional codes or cash-back offers tied to certain retailers, further sweetening the deal. It’s also wise to check the retailer’s return policy, as the lowest price isn’t always the best deal if returning the item is a hassle.

Buy in Bulk Wisely

Buying in bulk can be a double-edged sword. While it often results in a lower cost per unit, it’s essential to be strategic about it. According to financial advisor Jane Smith, “Bulk buying is a great way to save on non-perishable items or things you use frequently, like toilet paper or canned goods. But it’s not always the best choice for perishables that might go bad before you use them.”

Warehouse clubs like Costco and Sam’s Club offer substantial savings on bulk items, but they also require a membership fee. Before signing up, consider how often you’ll shop there and whether the savings will offset the membership cost. Additionally, be mindful of storage space and whether you have the room to accommodate larger quantities. Buying in bulk is most beneficial when shared with family or friends, allowing you to split the cost and the products themselves.

Make Intentional Financial Choices

Ultimately, smart shopping is about making decisions that align with your financial goals. It’s a proactive approach that requires a bit of effort but pays off in the long run. By adopting these strategies, you’re not just saving money; you’re taking control of your financial future, one purchase at a time.

Consider setting a budget for your shopping trips and tracking your expenses to see where your money is going. This awareness can reveal patterns that you might not have noticed otherwise, such as over-spending in particular categories. Using apps like Mint or You Need a Budget can simplify this process and help you stay on track.

Incorporating these smart shopping strategies into your routine doesn’t mean you have to become a frugal zealot. It’s about finding a balance that works for you and allows you to enjoy life while still being financially responsible. By planning ahead, leveraging discounts, and making informed choices, you’re setting yourself up for success in both the short and long term. Happy shopping!