The Impact of Inflation on Your Investments and How to Protect Your Wealth

Inflation can significantly impact investment portfolios by eroding real returns, making it crucial for investors to understand its effects and adjust their strategies accordingly. While fixed-income investments like bonds struggle during inflationary times, tangible assets such as real estate and commodities typically offer better protection, and certain equities can also provide a buffer if companies can pass increased costs to consumers. To safeguard wealth, diversification across asset classes, international markets, and inflation-linked securities, alongside monitoring central bank policies, are key strategies to mitigate inflation's impact and ensure long-term wealth preservation.

Inflation is a bit like that silent, sneaky villain in a movie — you can't always see it happening, but it can wreak havoc on your finances if you're not paying attention. When the cost of living rises and your dollars don't stretch quite as far, that's inflation at work. And while we often talk about it in terms of groceries or gas prices, inflation can have just as dramatic an impact on your investment portfolio.

Imagine saving up for years, only to find out that your investments haven’t grown enough to keep up with rising costs. Not a pretty picture, right? That's why understanding how inflation affects your investments and knowing how to protect your wealth is crucial. Let's dive into what inflation means for your money and explore strategies to help you stay ahead.

Understanding Inflation's Effect on Investments

Inflation is essentially the rate at which the general level of prices for goods and services rises, eroding purchasing power. For investors, this can mean that the real return on investments — that’s your return after accounting for inflation — might be less than you expected. If you’re earning 5% on an investment, but inflation is at 3%, your real return is only 2%. It’s like running on a treadmill: you’re moving, but you’re not necessarily getting anywhere.

Fixed-income investments, like bonds, are particularly vulnerable during inflationary periods. When inflation goes up, the fixed interest payments these investments provide buy less, diminishing their real value. For instance, if you hold a bond yielding 4% while inflation is at 5%, you're effectively losing purchasing power over time.

Equities, or stocks, can offer a better hedge against inflation, but they're not a guaranteed safe haven. Companies that can pass increased costs on to consumers — think utilities or consumer staples — tend to perform better in inflationary environments. However, it's important to remember that not all stocks are created equal, and picking the right sectors is key.

Why Tangible Assets Shine During Inflation

When inflation is on the rise, tangible assets like real estate and commodities often come into their own. Real estate, for example, can provide a reliable income stream that often adjusts with inflation. As property values and rents increase, real estate investments tend to keep pace with, or even exceed, inflation rates, preserving and potentially enhancing your wealth.

Commodities, such as gold and silver, are also popular inflation hedges. They have intrinsic value and historically have been seen as a store of wealth, especially during economic uncertainty. Gold, in particular, is often dubbed a "safe haven" asset. Its prices tend to rise when inflation is high, as investors flock to it when paper currency’s value is falling.

However, it's important to approach commodities with caution. Their prices can be volatile, and they're influenced by factors beyond inflation, such as geopolitical events and supply shortages. A well-thought-out strategy is crucial if you're considering adding these assets to your portfolio.

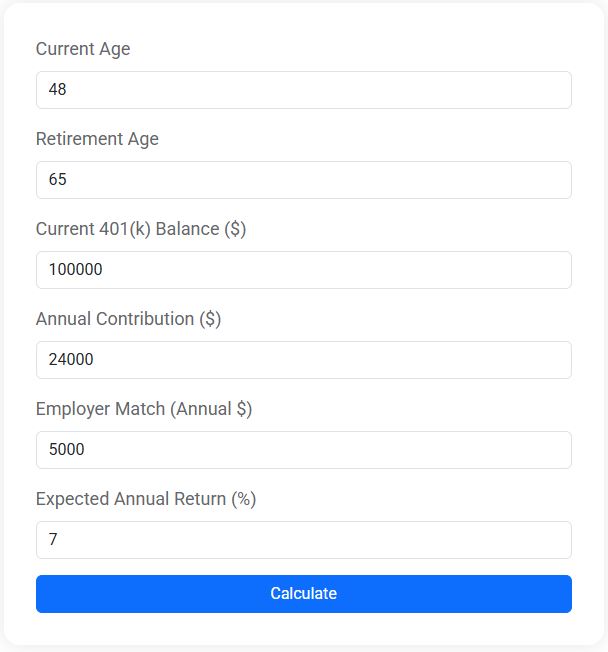

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Diversification: Your Best Defense

Diversification is a tried-and-true strategy for managing risk, and it's particularly effective against inflation. By spreading your investments across different asset classes, you can potentially offset losses in one area with gains in another. This might mean holding a mix of stocks, bonds, real estate, and commodities, each of which reacts differently to inflationary pressures.

International diversification can also be beneficial. Inflation rates vary across countries, and by investing in international markets, you can tap into economies with lower inflation or those that might benefit from global economic shifts. For example, emerging markets can offer growth opportunities that are less correlated with domestic inflation trends.

Another layer to consider is inflation-linked securities, like Treasury Inflation-Protected Securities (TIPS) in the U.S. These bonds adjust their principal value with inflation, ensuring that your investment keeps pace with the rising cost of living. It's like having a built-in inflation insurance policy on your investment.

Keeping an Eye on Central Bank Policies

The role of central banks in managing inflation cannot be overstated. Decisions made by institutions like the Federal Reserve can have a significant impact on inflation and, consequently, on your investments. When central banks change interest rates, it affects the cost of borrowing, consumer spending, and ultimately, inflation.

For instance, during periods of high inflation, central banks might increase interest rates to cool down the economy. This can reduce borrowing and spending, eventually bringing inflation down. However, higher interest rates can also lead to decreased bond prices and potentially slower economic growth, impacting stock performance.

Staying informed about central bank policies and economic indicators can provide valuable insights into future inflation trends. As financial advisor Jane Smith mentions, "Being proactive about understanding macroeconomic policies can help you make informed decisions about your investment strategy."

Practical Steps to Safeguard Your Wealth

In the face of inflation, taking proactive steps to protect your investments is essential. Start by reviewing your asset allocation to ensure it's aligned with your financial goals and risk tolerance. Consider sectors and industries that have historically performed well during inflationary periods, such as energy, healthcare, and consumer staples.

Rebalancing your portfolio regularly is also crucial. This involves adjusting your investments to maintain your desired level of risk and return. By doing so, you can capitalize on market opportunities and ensure that your portfolio remains resilient against inflationary pressures.

Finally, don't underestimate the importance of professional advice. A financial advisor can offer tailored insights and strategies based on your unique circumstances. As CNBC points out, "Navigating inflation with a trusted advisor can provide peace of mind and a clearer path to achieving your financial objectives."

Inflation may be an inevitable part of economic cycles, but with the right strategies, you can protect your wealth and even find opportunities to grow it. By understanding its impact, diversifying your investments, and staying informed, you can ensure that your financial future remains on solid ground, no matter how the winds of inflation blow.