Tax Season Survival Guide: Tips for Minimizing Stress

Getting organized early with your tax documents, such as W-2s and receipts, can significantly reduce stress and prevent last-minute errors during tax season. Understanding applicable deductions and credits, like mortgage interest and the earned income tax credit, can lower your tax bill, while e-filing can simplify the process with fewer errors and quicker refunds. If your taxes are complex, consider hiring a professional to help maximize your savings, and plan ahead by adjusting your withholdings and tracking expenses throughout the year for a smoother experience next time.

As the chill of winter begins to thaw, tax season looms ever closer, often bringing with it a sense of dread. We’ve all been there: grappling with a mountain of documents, struggling to decipher tax jargon, and praying that we’ve done everything right. But the good news is, it doesn't have to be an overwhelming ordeal. With some strategic planning and a few insider tips, you can tackle tax season with confidence and minimal stress. Whether you’re a seasoned filer or a first-timer, this guide will help you navigate the complexities of tax time like a pro.

Tax season is a bit like running a marathon. You wouldn't show up at the starting line without any training, would you? By taking the time to prepare your materials and understand the rules of the game, you can cross the tax season finish line with ease. Let’s dive into some practical strategies to help you keep your cool and maybe even save some money in the process.

Get Organized Early

One of the simplest ways to reduce tax season stress is to get organized early. Start by gathering all necessary documents, such as W-2s, 1099s, and receipts for deductible expenses. Establish a dedicated spot for these materials, whether it's a physical folder or a digital one. By having everything in one place, you'll avoid the last-minute scramble to find that one missing document.

A personal anecdote: I once spent a frantic evening searching for a receipt from a charitable donation, only to find it weeks later tucked inside a book. Lesson learned—the more organized you are, the less likely you’ll be to miss out on potential deductions. According to a study by the IRS, taxpayers who organized their paperwork ahead of time were 50% less likely to make errors on their returns.

Understand Deductions and Credits

Deductions and credits are your allies when it comes to reducing your tax bill. It's crucial to know which ones apply to your situation. For example, if you own a home, you might be eligible to deduct mortgage interest. Or, if you have children, the Child Tax Credit could be a significant savings boon.

Consider the Earned Income Tax Credit (EITC), a benefit for working people with low to moderate income. Millions of eligible taxpayers fail to claim it each year simply because they don't know they qualify. Financial expert Jane Smith notes, "Understanding what deductions and credits you can claim can make a huge difference in your tax outcome." Research and ask questions if you're unsure—it's worth the effort.

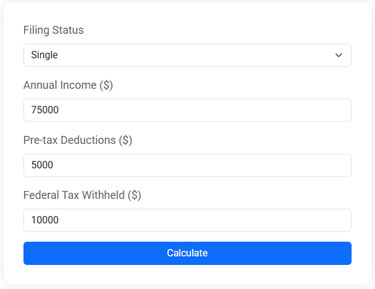

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Embrace E-Filing

Gone are the days of dealing with paper forms and snail mail. E-filing your taxes not only simplifies the process but also reduces the chance of errors. The IRS reports that e-filed returns have an error rate of less than 1%, compared to around 20% for paper returns. Plus, e-filing usually results in quicker refunds—something most of us can get behind.

Many tax software options offer step-by-step guidance and even alert you to potential deductions you may have overlooked. For example, TurboTax and H&R Block provide user-friendly platforms that make the process almost painless. Plus, many states offer free e-filing for simple returns, so it’s worth exploring these options.

Consider Hiring a Professional

If your tax situation is complex—think multiple income sources, investments, or business ownership—consider hiring a professional. Tax professionals can navigate the labyrinth of tax laws and ensure you're maximizing your savings. The cost of hiring a CPA or tax preparer often pays for itself in the form of tax savings and peace of mind.

According to CNBC, approximately 40% of Americans use tax professionals. As tax consultant Laura Johnson explains, "A knowledgeable accountant can identify deductions and tax strategies you might not be aware of." When choosing a professional, seek out recommendations and verify their credentials to ensure you're getting quality assistance.

Adjust Your Withholdings

Between tax seasons, take some time to review and, if necessary, adjust your withholdings. By doing so, you can avoid the unpleasant surprise of owing money or the inefficiency of a large refund. Use the IRS's withholding calculator or consult with a tax professional to determine the right amount to withhold from your paycheck.

Adjusting withholdings might seem daunting, but it's a proactive step that can make a big difference. For example, if you received a significant refund last year, you might want to adjust your withholdings so you have more take-home pay throughout the year rather than giving the government an interest-free loan.

Plan for Next Year

Finally, as you wrap up this year's taxes, start planning for next year. Keep track of your expenses, especially if you’re self-employed or have deductible expenses. Maintain a record-keeping system that works for you, whether that’s digital or paper-based.

Consider setting up quarterly check-ins with yourself or your tax professional to review your financial situation and make adjustments as needed. By staying on top of things year-round, you’ll find that when tax season rolls around again, you’ll be in a much better position. As Ben Franklin wisely noted, "An ounce of prevention is worth a pound of cure." In the realm of taxes, preparation truly is key.

By following these strategies, you’ll not only minimize tax season stress but also potentially boost your financial health. Remember, the goal is to make the process as smooth as possible. With a little foresight and effort, you can conquer tax season with confidence and maybe even a smile.