Maximizing Your Retirement Savings with Tax-Efficient Strategies

Maximizing your retirement savings hinges on implementing tax-efficient strategies, such as utilizing tax-advantaged accounts like IRAs and 401(k)s, and strategically timing contributions to optimize tax benefits. Taking full advantage of employer matching, making catch-up contributions if you're 50 or older, and selecting tax-efficient investments can substantially boost your savings while minimizing tax liabilities. Regularly reviewing and adjusting your strategy, with professional advice if needed, ensures your retirement plan adapts to changing tax laws and personal circumstances, setting you up for a secure financial future.

Maximizing your retirement savings isn't just about stashing away every spare penny—it's about doing so wisely and efficiently. A crucial component of this strategy is understanding and harnessing the power of tax-efficient savings. By leveraging tax-advantaged accounts, timing contributions strategically, and optimizing your investment choices, you can significantly enhance your nest egg while keeping Uncle Sam from taking more than his fair share. It's not just about saving; it's about saving smartly.

Imagine sitting across from a financial planner who casually mentions, "You could have saved a few thousand more last year if you’d adjusted your contributions." It’s a gut punch no saver wants. Fortunately, with a little insight and some proactive planning, you can make sure that doesn’t happen to you.

Understanding Tax-Advantaged Accounts

Tax-advantaged accounts like IRAs and 401(k)s are often the backbone of a solid retirement strategy. These accounts offer tax benefits that can significantly impact your savings growth over time. With a traditional 401(k), for instance, contributions are made with pre-tax dollars, which lowers your taxable income in the year you contribute. This means you pay less tax now and defer paying taxes until you withdraw funds in retirement, ideally when you're in a lower tax bracket.

Roth IRAs, on the other hand, are funded with after-tax dollars. You don't get a tax break on contributions, but withdrawals in retirement are generally tax-free. This can be a substantial benefit if you anticipate being in a higher tax bracket later. As financial advisor Jane Smith explains, "Choosing between a traditional and Roth IRA often depends on your current tax situation and your expectations for the future."

Strategically Timing Contributions

Timing is everything, especially when it comes to contributing to your retirement accounts. By front-loading your contributions—putting in as much as you can at the beginning of the year—you could potentially take advantage of more compound interest. The earlier your money is in the market, the longer it has to grow.

Moreover, consider how your contributions align with your income fluctuations. If you expect a year with higher income, it might be beneficial to max out your pre-tax contributions to lessen your tax burden. According to CNBC, even small tweaks to the timing of your contributions can lead to significant tax savings over the years, potentially thousands of dollars.

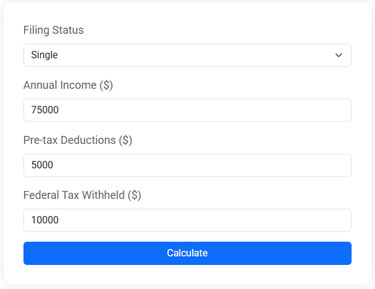

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Making the Most of Employer Matching

Employer matching in retirement plans like a 401(k) is essentially free money. If your employer offers a match, it's crucial to contribute enough to get the full benefit. For example, if your employer matches 50% of contributions up to 6% of your salary, and you earn $60,000 a year, failing to contribute at least $3,600 means leaving $1,800 of free money on the table.

Think of it this way: missing out on employer matching is like refusing a raise. It's one of the simplest ways to instantly boost your retirement savings without extra effort. As financial planner John Doe says, "Maximizing your employer match should be a priority for anyone serious about growing their retirement savings."

Utilizing Catch-Up Contributions

For those aged 50 and older, the IRS allows catch-up contributions, which can be a game-changer for your retirement savings. In 2023, you can contribute an additional $7,500 to your 401(k) and an extra $1,000 to your IRA. These additional contributions can accelerate your savings significantly as you approach retirement age.

Catch-up contributions are particularly beneficial if you started saving late or have gaps in your retirement savings. They provide an opportunity to make up for lost time and potentially benefit from additional tax advantages. Consider them a second chance to bolster your financial security in retirement.

Selecting Tax-Efficient Investments

Choosing the right investments within your retirement accounts can also have tax implications. Generally, it's wise to hold tax-inefficient investments, like bonds or REITs, in tax-advantaged accounts to shield them from taxes. Meanwhile, tax-efficient investments, such as index funds or ETFs, may be better suited for taxable accounts.

For example, index funds often generate lower taxable distributions compared to actively managed funds, making them a tax-savvy choice for long-term growth. As The Wall Street Journal highlights, even small differences in tax efficiency can compound into significant savings over decades.

Regularly Reviewing and Adjusting Your Strategy

Tax laws and personal circumstances are not static, which means your retirement strategy shouldn't be either. Regularly reviewing and adjusting your plan ensures it remains aligned with your goals and the current tax landscape. This might involve re-evaluating your contribution levels, investment choices, or even the types of accounts you use.

Don't hesitate to seek professional advice if needed. A financial advisor can provide personalized insights and help you navigate complex tax rules. As tax expert Emily Chen advises, "Staying informed and flexible is key to maximizing tax efficiency and ensuring your retirement savings strategy stays on track."

Embracing these tax-efficient strategies can make a substantial difference in how much you save for retirement and how well those savings work for you. By understanding and applying these principles, you're not only setting yourself up for a more secure financial future but also making the most of the resources available to you. It’s about working smarter, not just harder, to achieve your retirement dreams.