Uncover Hidden Tax Credits to Lower Your Tax Bill

Tax credits, often overlooked compared to deductions, can significantly reduce your tax liability by directly lowering the amount you owe. Key credits to consider include the American Opportunity Tax Credit and Lifetime Learning Credit for education expenses, the Earned Income Tax Credit for low to moderate-income workers, the Child and Dependent Care Credit for families with dependents, and energy-efficiency credits for home improvements. Understanding and utilizing these credits can greatly enhance your financial health, so consulting a tax professional might be beneficial as tax season nears.

Tax season can feel a bit like a trip to the dentist—necessary but not exactly something you look forward to. Yet, there's a silver lining in the form of tax credits that can make the process not only less painful but potentially rewarding. Unlike deductions, which lower your taxable income, tax credits directly reduce the amount of tax you owe. This makes them a powerful tool for anyone looking to lower their tax bill. However, many taxpayers overlook these credits, often because they aren't aware of them or don't understand how to qualify. Let's uncover some of these hidden gems that could put a little more money back in your pocket.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit is a boon for those investing in their education or the education of a dependent. The AOTC can be worth up to $2,500 per eligible student, covering expenses such as tuition, books, and supplies required for coursework. To claim this credit, the student must be pursuing a degree or other recognized educational credential and be enrolled at least half-time for one academic period during the tax year.

What's fantastic about the AOTC is that 40% of it is refundable, which means you could get up to $1,000 back even if you owe no taxes. That's essentially free money for your education! Just remember, there are income limits: the credit begins to phase out if your modified adjusted gross income (MAGI) exceeds $80,000, or $160,000 for joint filers. It's worth checking your eligibility each year, as circumstances can change.

Lifetime Learning Credit (LLC)

If you're not eligible for the AOTC, perhaps because you're taking fewer credits or not pursuing a degree, the Lifetime Learning Credit might be the ticket. This credit is worth up to $2,000 per tax return, not per student, and can be used for any level of post-secondary education or even courses to acquire or improve job skills.

Unlike the AOTC, the LLC is non-refundable, so it can only reduce your tax liability to zero. However, its flexibility makes it a valuable option for lifelong learners. The income limits are slightly lower, with the phase-out beginning at a MAGI of $59,000 for single filers and $118,000 for joint filers. Always double-check the most current thresholds as they can adjust annually.

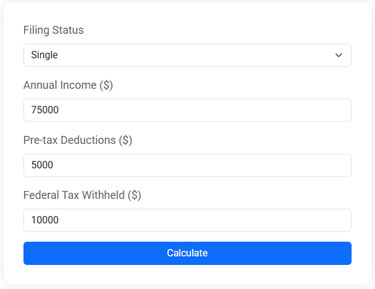

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Earned Income Tax Credit (EITC)

For low to moderate-income workers, the Earned Income Tax Credit is one of the most significant credits available. Depending on your income, marital status, and number of children, the EITC can be worth up to $6,660. This credit is both refundable and, in many cases, transformative for those who qualify, often providing a substantial refund that can be used to pay off debt or build savings.

Unfortunately, the EITC is also one of the most overlooked credits, with millions who qualify failing to claim it. According to the IRS, about 20% of eligible taxpayers do not claim the credit. If you think you might qualify, it's worth using the IRS's EITC Assistant tool to check your eligibility and understand how this credit can benefit you.

Child and Dependent Care Credit

For families with dependents, the Child and Dependent Care Credit can provide much-needed relief. This credit can cover a portion of the costs for daycare, babysitters, or even summer camps, up to $3,000 for one dependent or $6,000 for two or more dependents. The percentage of expenses you can claim varies based on your income, but it can be as high as 35%.

To qualify, the care must be necessary for you (and your spouse, if filing jointly) to work or look for work. It's a credit that can make a big difference, especially for working parents juggling the costs of raising a family. Always ensure you're keeping receipts and records of your expenses to substantiate your claim.

Energy-Efficiency Credits

Going green isn't just good for the planet—it can also be good for your wallet. Energy-efficiency credits are available for homeowners who make improvements that reduce their energy consumption. This includes things like installing solar panels, energy-efficient windows, or geothermal heat pumps. While the specific credits can vary, they often cover 10% to 30% of the cost of qualifying improvements.

The Residential Energy Efficient Property Credit, in particular, can be quite lucrative, offering a credit for 26% of the cost of solar, wind, and other renewable energy installations through 2022, before gradually phasing down. Always check the current year's incentives, as these can be subject to legislative changes.

Consulting a Tax Professional

While these credits can significantly reduce your tax liability, navigating them can be complex, especially if you're not well-versed in tax law. This is where consulting a tax professional can provide a big advantage. Not only can they help you understand which credits you qualify for, but they can also ensure you're maximizing your refund and avoiding costly mistakes.

According to financial advisor Jane Smith, "A good tax professional can more than pay for their services by finding credits and deductions you might miss on your own." As tax season approaches, consider reaching out to a trusted professional to ensure you're leveraging every available opportunity to reduce your tax bill.

In the end, tax credits are a powerful tool that can have a significant impact on your financial health. By understanding and utilizing these credits, you can keep more of your hard-earned money and make tax season a little brighter. So grab a cup of coffee, sit down with your tax documents, and start exploring these hidden gems that might just boost your bottom line.