Top Tax-Saving Strategies for Small Business Owners

Small business owners can significantly reduce their tax liabilities and reinvest savings back into their businesses by implementing strategic tax-saving measures. Key strategies include maximizing business deductions, setting up retirement plans like SEP IRAs or Solo 401(k)s, leveraging tax credits, taking advantage of the Qualified Business Income deduction, and optimizing their business structure. Consulting with a tax professional can help navigate these often complex strategies and ensure maximum tax benefits.

Small business ownership is a rewarding journey filled with the thrill of being your own boss and the satisfaction of watching your vision come to life. However, one aspect that often leaves business owners scratching their heads is navigating the murky waters of taxes. With tax season perpetually lurking around the corner, understanding how to minimize tax liabilities is crucial for reinvesting in and growing your business. Fortunately, there are several strategies that can help reduce your tax burden and keep more of your hard-earned money in your pocket.

In this guide, we'll explore some of the top tax-saving strategies for small business owners. From maximizing deductions to leveraging tax credits, these tactics can make a significant difference in your financial bottom line. While this article will provide a solid foundation, remember that consulting with a tax professional can tailor these strategies to your unique circumstances and ensure compliance with the ever-changing tax laws.

Maximize Business Deductions

Business deductions are one of the most straightforward ways to reduce taxable income. Any ordinary and necessary expense that is incurred in the course of running your business can potentially be deducted. This includes costs like office supplies, software subscriptions, and even a portion of your home office if you work from home. The key to maximizing deductions is maintaining meticulous records and receipts.

For example, if you frequently travel for business, consider all the related expenses that can be deducted. This includes airfare, hotel stays, and even meals. As financial advisor Jane Smith points out, "Many small business owners overlook the small expenses that add up over time. Keeping detailed records ensures nothing slips through the cracks."

Don't forget about depreciation. If you’ve invested in equipment or technology for your business, you can deduct the cost over several years. This not only helps with cash flow but also spreads out the tax benefit. It's essential to work with your accountant to determine the best depreciation method for your situation.

Set Up Retirement Plans

Setting up a retirement plan not only secures your future but can also offer substantial tax benefits. Options like Simplified Employee Pension (SEP) IRAs or Solo 401(k)s are particularly appealing for small business owners. These plans allow you to contribute a significant portion of your income, reducing your taxable income in the process.

Take the SEP IRA, for instance. In 2023, you can contribute up to 25% of your net earnings from self-employment, up to a maximum of $66,000. Contributions are tax-deductible, providing an immediate tax break. Similarly, a Solo 401(k) allows for both employee and employer contributions, potentially doubling your savings.

According to CNBC, "business owners who actively contribute to their retirement plans not only enjoy tax advantages today but also build wealth for the future." It's a win-win situation that shouldn't be overlooked.

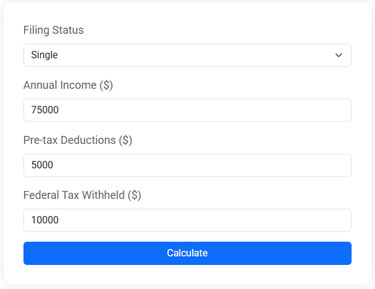

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Leverage Tax Credits

Tax credits are often more valuable than deductions because they reduce your tax liability dollar for dollar. Several credits are available specifically for small businesses. The Research and Development (R&D) tax credit, for example, rewards businesses for investing in innovation and development.

Another valuable credit is the Work Opportunity Tax Credit (WOTC), which incentivizes hiring individuals from certain target groups who face significant barriers to employment. This not only helps reduce your tax bill but also promotes diversity and inclusion within your workforce.

Energy-efficient improvements also come with potential tax credits. Whether you're investing in solar panels or energy-efficient HVAC systems, these upgrades can provide a double benefit of reducing operational costs and securing tax credits. Always check for the latest tax credits applicable to your business and industry.

Take Advantage of the Qualified Business Income Deduction

The Qualified Business Income (QBI) deduction, introduced as part of the Tax Cuts and Jobs Act, allows eligible businesses to deduct up to 20% of their qualified business income. This deduction is available to sole proprietors, partnerships, and S-corporations, providing a substantial tax break for many small business owners.

Calculating the QBI deduction can be complex, as it involves several variables, including your total taxable income and the type of business you operate. As tax expert John Doe advises, "It's vital to work with a tax professional to ensure you're calculating this deduction correctly, as mistakes can lead to costly penalties."

It's also important to note that the QBI deduction has limitations based on income levels and business types. Understanding these nuances is crucial to maximizing your tax benefits.

Optimize Your Business Structure

The structure of your business can significantly impact your tax liability. While many small businesses start as sole proprietorships due to simplicity, evolving into an LLC, S-corporation, or C-corporation might offer better tax advantages as your business grows.

For instance, S-corporations can help reduce self-employment taxes, as income is passed through to the owners and taxed at individual rates, avoiding the double taxation faced by C-corporations. However, C-corporations might be beneficial if you plan to reinvest most of your profits into the business, thanks to lower corporate tax rates.

It's important to weigh the pros and cons of each structure with a tax advisor. They can provide insights specific to your business goals and financial situation, helping you choose the structure that maximizes tax efficiency and growth potential.

Navigating the intricate world of small business taxes can feel overwhelming, but implementing these strategies can lead to considerable savings and a healthier financial future for your business. While this article provides a foundation, remember that each business is unique. Partnering with a knowledgeable tax professional can ensure you're making the most of available opportunities while staying compliant with current tax laws. By doing so, you'll not only save money but also gain peace of mind, allowing you to focus on what you do best: running your business.