Get Ahead of Your Taxes: Smart Strategies for Early Filers

Filing taxes early can lead to a smoother experience and potentially larger refunds by avoiding the last-minute rush and allowing more time for strategic planning. Key strategies include organizing financial documents, staying informed about tax law changes, maximizing retirement contributions, reviewing potential deductions and credits, and considering electronic filing for speed and accuracy. By tackling taxes head-on, early filers can reduce stress and optimize their tax savings.

Filing taxes is one of those yearly tasks that often gets pushed to the last minute. But what if you could turn this annual chore into an opportunity for financial optimization? Filing your taxes early isn't just about getting ahead of the game; it's about setting yourself up for a smoother, more strategic tax season. By tackling taxes head-on, early filers can reduce stress, avoid the last-minute rush, and even potentially boost their refunds.

Many people don't realize the advantages that come with being an early bird when it comes to taxes. Not only do you have more time to gather and organize your financial documents, but you also give yourself the opportunity to make informed decisions about deductions, credits, and contributions. Plus, with tax laws frequently changing, staying informed can make a significant difference in your filing strategy. So, let's delve into some smart strategies for early filers that could help you make the most out of this tax season.

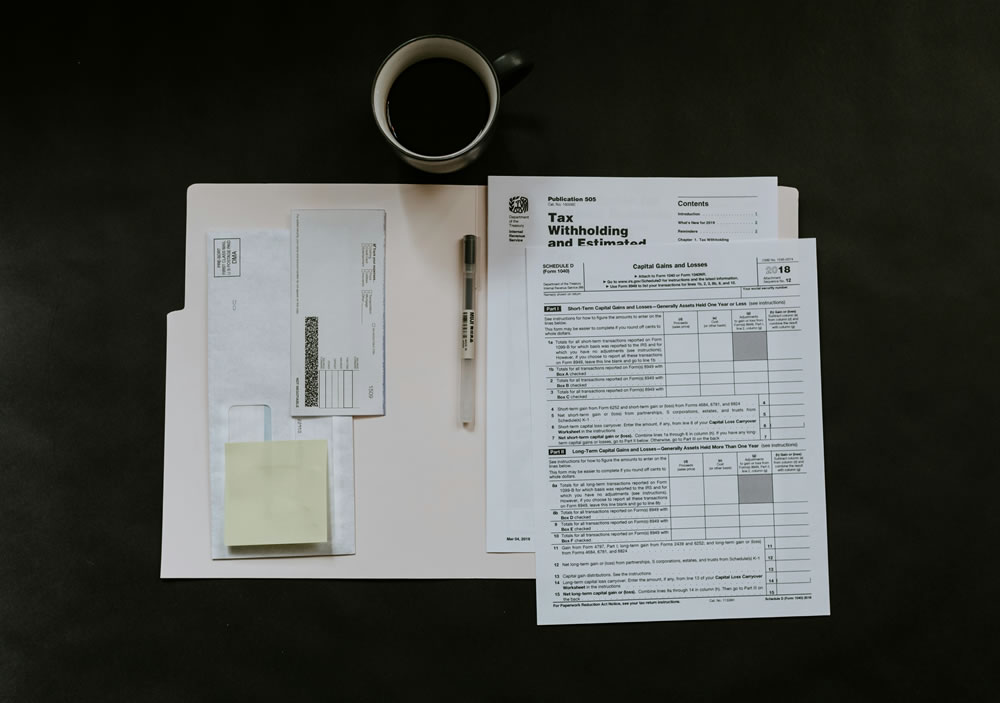

Organize Your Financial Documents

The foundation of a smooth tax filing experience is organization. Start by gathering all the necessary documents such as W-2s, 1099s, mortgage interest statements, and any documentation related to deductions and credits. If you've made charitable contributions, ensure you have records of these as well. The earlier you start this process, the more time you’ll have to request any missing documents from employers or financial institutions.

Using digital tools can streamline this process significantly. Consider apps or software that allow you to digitally scan and store documents, making them easily accessible when it's time to file. According to a study by the Journal of Accountancy, taxpayers who organize their documents digitally reported a 30% reduction in time spent on tax preparation. This not only saves time but also reduces the stress of last-minute scrambling for paperwork.

Stay Informed About Tax Law Changes

Tax laws are notorious for changing, sometimes with little notice. For early filers, staying informed about these changes can mean the difference between a standard filing and a strategic one. For instance, changes in tax brackets, deductions, or credits can directly impact your return. By keeping abreast of these updates, you can adjust your financial strategy accordingly.

A practical way to stay informed is by subscribing to newsletters from reliable sources like the IRS website or financial news outlets such as Forbes or CNBC. Financial advisor Jane Smith emphasizes the importance of understanding these changes: "Being aware of tax law updates allows you to make informed decisions, potentially saving you hundreds or even thousands of dollars."

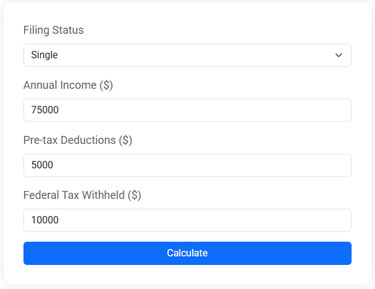

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Maximize Retirement Contributions

One of the most effective strategies for reducing your taxable income is maximizing your retirement contributions. Contributions to accounts like a 401(k) or an IRA can not only boost your retirement savings but also lower your taxable income for the year. The earlier you file, the more time you have to make these contributions before the tax deadline, if you haven't already maxed out.

For example, if you're under 50, you can contribute up to $22,500 to your 401(k) in 2023. If you're 50 or older, the catch-up contribution allows you to add an extra $7,500. These contributions are tax-deductible and can significantly reduce your overall tax bill. As financial planner Sarah Johnson notes, "Contributing to retirement accounts is one of the best ways to both save for the future and reduce your current tax liability."

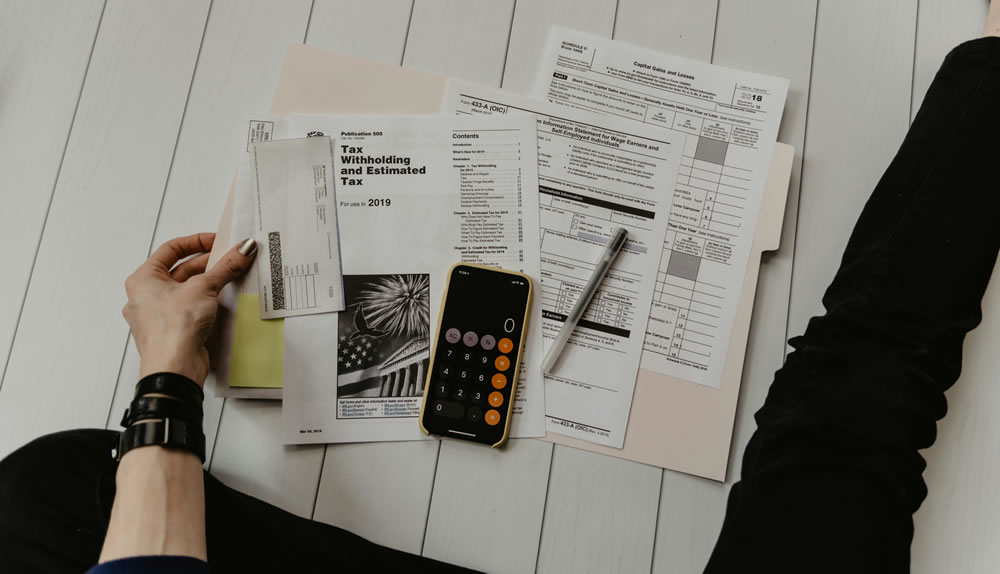

Review Potential Deductions and Credits

Deductions and credits can significantly impact the size of your refund or the amount you owe. While deductions reduce your taxable income, credits reduce your tax bill dollar-for-dollar. Understanding which ones apply to you is crucial for optimizing your tax strategy. For instance, education credits like the American Opportunity Credit or deductions for student loan interest can lead to substantial savings.

Take the time to review your eligibility for less obvious deductions and credits, such as those for energy-efficient home improvements or child and dependent care expenses. Early filers who thoroughly review these options often find additional savings that they might have otherwise overlooked. According to tax expert Robert Lee, "Many taxpayers miss out on valuable credits simply because they rush through their filing."

Consider Electronic Filing for Speed and Accuracy

In today's digital age, electronic filing is often the fastest and most accurate way to submit your taxes. E-filing can help reduce errors, as tax software typically checks for common mistakes and guides you through the process. This can be particularly useful for early filers who may be navigating new or complex tax situations.

Moreover, e-filing usually results in faster refunds, as the IRS processes electronic returns more quickly than paper ones. According to the IRS, about 90% of taxpayers who e-file receive their refund within three weeks. For those who file early, this means getting your refund sooner and having more time to plan how you'll use it—whether that's paying down debt, saving, or investing.

Time for Strategic Planning

One of the key advantages of filing early is having ample time for strategic planning. Rather than rushing to meet the tax deadline, early filers can take a step back and think about how to optimize their financial situation. This might involve reassessing income sources, considering changes in employment, or planning for future tax years.

For instance, if you anticipate a higher income next year, you might adjust your withholdings or explore tax-advantaged investment opportunities. As financial strategist Mark Thompson advises, "Filing early provides a unique window to reflect on your financial health and make proactive adjustments."

By adopting these smart strategies and filing your taxes early, you're not just checking off a box; you're taking control of your financial future. The process doesn't have to be a last-minute scramble—it can be an opportunity to optimize your tax savings and reduce stress. So, grab a cup of coffee, gather those documents, and start filing. Your future self will thank you.