Unlocking the Secrets of Compound Interest: How to Make Your Money Work for You

Compound interest, often dubbed the eighth wonder of the world, is a powerful financial tool that grows wealth by earning interest on both the initial principal and accumulated interest over time. To fully harness its potential, it's crucial to start investing early, make regular contributions, choose strategic investments, and be mindful of factors like fees and inflation that can erode returns. By doing so, you can significantly enhance your financial future, allowing compound interest to work its magic over the long term.

Compound interest is often hailed as the "eighth wonder of the world," a phrase attributed to none other than Albert Einstein. But what makes compound interest so magical, you ask? It's the ability to grow your wealth exponentially by earning interest not just on your initial investment, but also on the interest that accumulates over time. This seemingly simple concept has the power to transform your financial future, turning modest savings into substantial wealth if given time to work its magic.

Understanding compound interest isn't just for financial wizards or Wall Street tycoons. It's a tool that anyone can use, regardless of where they are in their financial journey. Whether you're just starting out in your career or looking to bolster your retirement savings, knowing how to leverage compound interest can make a world of difference. Let’s dive into the nuts and bolts of compound interest and explore how you can make it work for you.

The Basics of Compound Interest

At its core, compound interest is the process of earning interest on both your original investment (the principal) and the interest that has already been added to your account. Think of it as interest on interest. This compounding effect can dramatically increase the value of your investments over time. The key factor here is time; the longer you leave your money to grow, the more pronounced the effects of compounding.

To illustrate, imagine you invest $1,000 at an annual interest rate of 5%. After the first year, you'd earn $50 in interest. In the second year, you earn interest on $1,050 (your initial investment plus the interest from the first year), which amounts to $52.50. This cycle repeats, with each year generating more interest than the last. Over decades, this can lead to significant growth, especially if you make regular contributions to your investment.

The Power of Starting Early

One of the most compelling aspects of compound interest is how much it rewards those who start early. The earlier you begin investing, the more time your money has to grow. To put this into perspective, consider two investors: Sarah and John. Sarah starts investing $200 a month at age 25, while John starts the same monthly investment at age 35. Assuming an average annual return of 7%, by the time they both reach 65, Sarah's investment would have grown to over $500,000, while John's would be around $230,000.

This example highlights the importance of time in the compounding equation. The decade-long head start gives Sarah's money more time to compound, leading to significantly greater wealth. It's a reminder that in the world of compound interest, time is truly money.

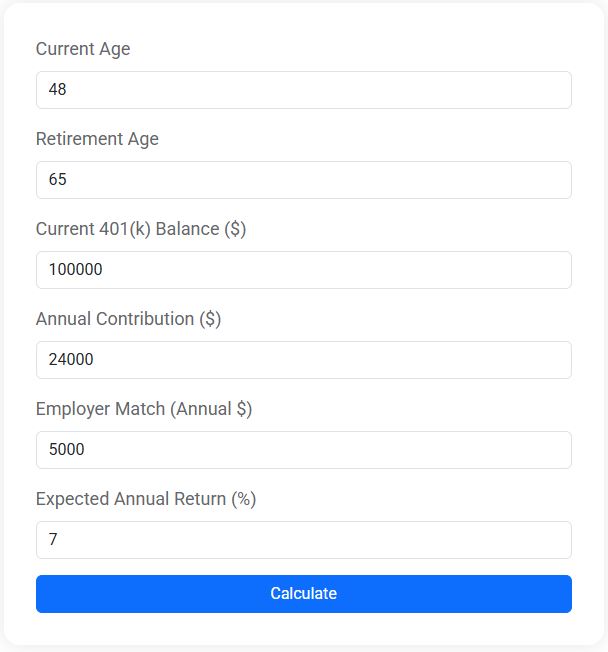

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Regular Contributions: The Habit That Pays Off

Making consistent contributions to your investment account is another powerful way to maximize the benefits of compound interest. It's not just about the amount you start with, but how disciplined you are in adding to your investment over time. This strategy, often referred to as dollar-cost averaging, involves regularly investing a fixed amount, regardless of market conditions.

This approach has two main benefits. First, it helps smooth out the volatility of the market by purchasing more shares when prices are low and fewer when prices are high. Second, it encourages a habit of saving and investing, which is crucial for long-term financial health. Even small, regular contributions can add up significantly over time, thanks to the power of compounding.

Choosing Strategic Investments

While compound interest is a powerful tool, not all investments are created equal. The rate at which your money compounds depends on the returns of your investments, so it’s important to choose wisely. Stocks, for example, historically offer higher returns than bonds or savings accounts, but they also come with higher risk. Diversifying your portfolio can help manage this risk while still providing the potential for growth.

As financial advisor Jane Smith explains, “A well-diversified portfolio is like a balanced diet — it ensures that you’re getting the right mix of nutrients, or in this case, returns, while minimizing risk.” By combining various asset classes, you can optimize your portfolio for growth while protecting against market downturns. This strategic approach allows compound interest to work more effectively, increasing your wealth over time.

Beware of Fees and Inflation

While compound interest can significantly grow your wealth, there are factors that can hinder its effectiveness. Fees and inflation are two such culprits. Investment fees, whether from mutual funds, ETFs, or financial advisors, can eat into your returns, leaving less money to compound. It’s essential to be mindful of these fees and seek low-cost investment options whenever possible.

Inflation, on the other hand, erodes the purchasing power of your money over time. If your investments don’t keep pace with inflation, you might find that your future buying power is less than expected. To combat this, aim for investments that offer returns above the rate of inflation, ensuring that your money retains its value over the long term.

Patience: The Unsung Hero of Compound Interest

In a world obsessed with instant gratification, patience is often overlooked but incredibly valuable when it comes to investing. Compound interest is a long game; it requires time and patience to see the full benefits. This means resisting the urge to withdraw your investments prematurely or panic-sell during market downturns.

Consider the story of Warren Buffett, one of the world’s most successful investors, who credits much of his wealth to patience and the power of compounding. His philosophy of buying quality investments and holding them for the long term has allowed him to amass a fortune over decades. By staying the course and remaining patient, you too can harness the full potential of compound interest.

As you embark on your journey to financial growth, remember that harnessing the power of compound interest is not about quick wins but about making smart, consistent choices over time. By starting early, making regular contributions, choosing strategic investments, and being mindful of fees and inflation, you can unlock the secrets of compound interest and pave the way to a more prosperous financial future.