Bitcoin and Beyond: Exploring the World of Cryptocurrency Investing

Cryptocurrency has transitioned into a mainstream investment option, attracting both individual investors and financial institutions, with Bitcoin as the most recognized name among a vast and evolving digital asset landscape. The article highlights the importance of understanding cryptocurrency fundamentals, diversifying investments within the crypto market, assessing associated risks, and choosing between long-term and short-term investment strategies. It also emphasizes the value of education and community engagement in making informed investment decisions in this volatile market.

Cryptocurrency has come a long way from its obscure beginnings. What started as a niche interest among tech enthusiasts has now blossomed into a global financial phenomenon. Today, cryptocurrency is not just a buzzword but a serious investment avenue attracting everyone from individual investors to titans of finance. Bitcoin, the first and most recognized cryptocurrency, often headlines this digital revolution, but it's merely the tip of the iceberg in a diverse and rapidly evolving market.

As cryptocurrency continues to gain traction, understanding its intricacies becomes crucial for anyone looking to dive in. Whether you're a seasoned investor or a curious newcomer, grasping the fundamentals, diversifying your portfolio, assessing risks, and choosing the right strategy are key components to navigating this volatile sea. Let's explore these essential aspects of crypto investing and uncover the value of education and community engagement in making informed decisions.

Understanding Cryptocurrency Fundamentals

Before you can invest confidently, it's important to understand what cryptocurrency really is. At its core, cryptocurrency is a digital or virtual currency that uses cryptography for security. This makes it incredibly difficult to counterfeit or double-spend. A defining feature of cryptocurrencies is that they are generally decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Bitcoin, created in 2009 by an anonymous person (or group) using the pseudonym Satoshi Nakamoto, was the first cryptocurrency and remains the most valuable today. However, thousands of alternative cryptocurrencies with various functions and levels of scarcity have since emerged. Ethereum, known for its smart contract functionality, and Ripple, designed for cross-border payments, are just two examples of how diverse the crypto landscape has become.

While the technology may seem complex, understanding these basics is critical. Cryptocurrency is not just about the potential for profit; it's about participating in a revolutionary technology that's reshaping our concept of money and finance. This understanding serves as the foundation upon which you can build your investment decisions.

Diversifying Within the Crypto Market

Diversification is a time-honored principle in investing, and it holds true in the world of cryptocurrency as well. While Bitcoin is often the entry point for many investors, looking beyond it can open up opportunities for growth and risk mitigation. Much like in traditional investing, a diversified portfolio can help protect against volatility in the market.

Consider a mix of established cryptocurrencies like Ethereum or Binance Coin alongside promising up-and-comers or niche players like Chainlink or Uniswap. Each of these has its own use case and growth potential, which can contribute to a balanced portfolio. For instance, Ethereum's utility in powering decentralized applications (dApps) gives it a different risk and growth profile compared to Bitcoin's store of value.

Moreover, diversifying isn't just about choosing different coins; it also involves varying your investment strategies within the crypto space. This might include staking, yield farming, or participating in initial coin offerings (ICOs), each of which comes with its own set of risks and rewards. By spreading your investments across different crypto assets and strategies, you can better navigate the market's ups and downs.

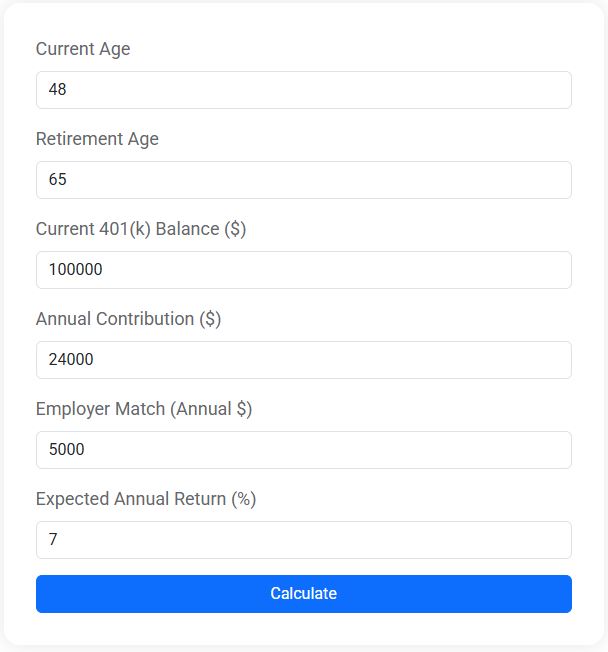

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Assessing Risks in Cryptocurrency Investing

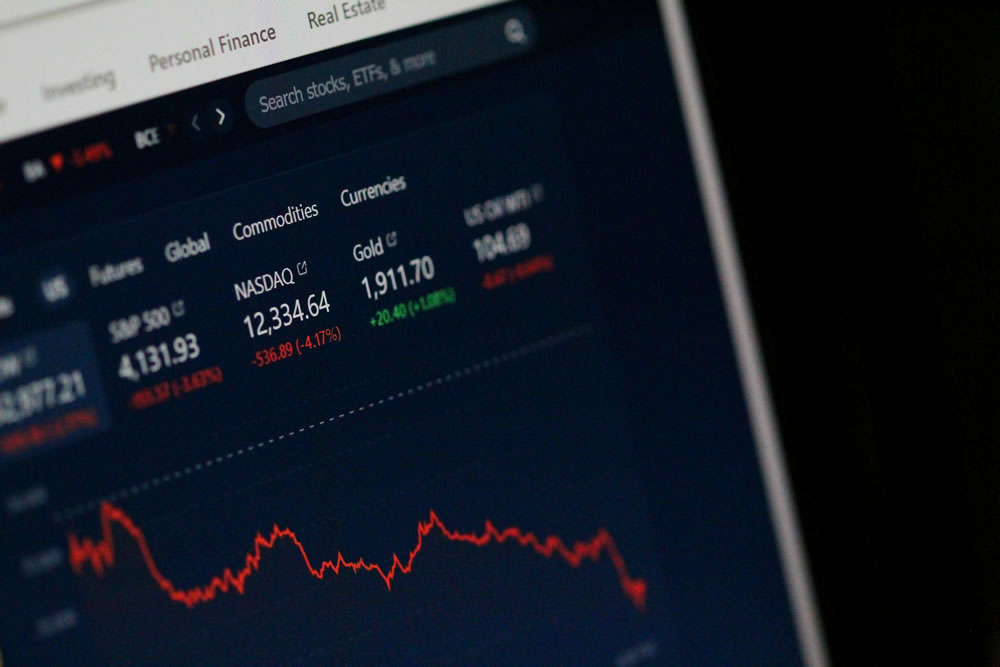

Investing in cryptocurrencies is not without its risks. Volatility is perhaps the most notable, with prices capable of wild swings in short periods. It's not uncommon to see double-digit percentage changes in a single day. This unpredictability is often driven by market sentiment, regulatory news, and technological developments.

Security is another significant concern. While blockchain technology is inherently secure, the platforms where cryptocurrencies are traded or stored can be vulnerable. Hacks and scams are unfortunately common, with millions of dollars worth of crypto assets lost in high-profile breaches. As such, it's crucial to use reputable exchanges and secure wallets to protect your investments.

Regulatory risk also looms large. As governments around the world grapple with how to manage and regulate cryptocurrencies, changes in legislation can have immediate and impactful consequences on the market. Staying informed about regulatory developments in your country and globally can help you anticipate and respond to these shifts.

Choosing Between Long-term and Short-term Strategies

When it comes to investment strategies, the crypto market offers both short-term and long-term opportunities. Short-term trading, often referred to as day trading, involves taking advantage of the market's volatility to make quick profits. This approach requires a keen understanding of market trends and a high tolerance for risk.

On the other hand, a long-term strategy—often called "HODLing," a misspelled term that has become synonymous with buy-and-hold—focuses on the potential for sustained growth over time. This approach can be less stressful and time-consuming, allowing investors to ride out the market's fluctuations with the belief in the underlying technology's eventual success.

Deciding on a strategy depends on your risk tolerance, time commitment, and investment goals. Some investors choose to blend these approaches, maintaining a core holding for the long haul while actively trading a smaller portion of their portfolio. This hybrid strategy can offer the best of both worlds but requires careful management and discipline.

The Value of Education and Community Engagement

Investing in cryptocurrency isn't just about numbers; it's also about understanding the community and staying educated. Engaging with the crypto community can provide valuable insights and support. Online forums, social media groups, and local meetups can connect you with others who share your interests and help you learn from their experiences.

Continuous learning is vital in the fast-paced world of crypto. The landscape is always shifting, with new coins, technologies, and regulations emerging regularly. Keeping up with these changes through webinars, podcasts, and reputable news sources can significantly enhance your investment acumen.

As financial advisor Jane Smith notes, "The most successful investors aren't necessarily the ones who make the most trades, but those who take the time to understand what they're investing in." By prioritizing education and engagement, you can make more informed decisions and adapt to the market's ever-changing dynamics with confidence.

In the end, cryptocurrency offers a unique investment frontier with both challenges and opportunities. By understanding the fundamentals, diversifying your portfolio, assessing risks, choosing the right strategies, and staying informed through community engagement, you can navigate the crypto world with greater assurance and potentially reap its rewards.