Investing in Real Estate: A Comprehensive Guide for Beginners

Real estate can be a lucrative investment option for beginners, offering various types such as residential, commercial, and industrial properties, each with its unique rewards and risks. To succeed, it's crucial to understand the localized market dynamics, secure the right financing, and effectively manage your properties. By balancing potential risks and rewards and making informed decisions, you can achieve financial growth and passive income through real estate investing.

Real estate investment often feels like a daunting realm reserved for seasoned professionals or those with deep pockets. However, this perception couldn't be further from the truth. Real estate offers a tangible and potentially rewarding investment avenue for beginners who are willing to learn the ropes. Unlike the stock market, which can seem abstract and volatile, real estate provides a physical asset you can see and touch. It also offers multiple paths to grow your wealth, from generating passive rental income to benefiting from property appreciation.

Yet, before you dive into buying properties, it's essential to understand the different types of real estate investments and the nuances of the market. This comprehensive guide aims to equip you with the foundational knowledge and insights needed to embark on your real estate investment journey with confidence.

Understanding Different Types of Real Estate

Real estate is not a one-size-fits-all investment. It includes a variety of sectors, each with its unique characteristics and opportunities. The most common types are residential, commercial, and industrial properties. Residential real estate involves properties like single-family homes, condos, and townhouses. These are typically rented out to individuals or families, offering a steady stream of income if managed well. For instance, a beginner might start by purchasing a duplex, living in one unit, and renting out the other to cover the mortgage—a strategy known as "house hacking."

Commercial properties, such as office buildings, retail spaces, and multifamily residences, often come with higher entry costs but can yield significant returns. The value of commercial real estate is largely driven by the income it generates, making it a favorite among investors seeking substantial cash flow. Lastly, industrial properties include warehouses and manufacturing facilities. These are generally stable long-term investments, especially with the growth of e-commerce driving demand for logistics spaces.

Market Research: The Key to Success

Diving into real estate without understanding market dynamics is like sailing without a compass. Every market has its unique trends, influenced by factors such as local economic conditions, population growth, and employment rates. For example, a city experiencing a tech boom might see a surge in housing demand, driving up both rental prices and property values.

Begin by researching a specific area you're interested in. Look at historical property prices, rental yields, and vacancy rates. Tools like Zillow, Redfin, or local real estate websites can provide valuable data. Also, consider talking to local real estate agents or attending community meetings to get a feel for the neighborhood's future prospects. Remember, a thorough understanding of the local market can help you identify lucrative investment opportunities and avoid potential pitfalls.

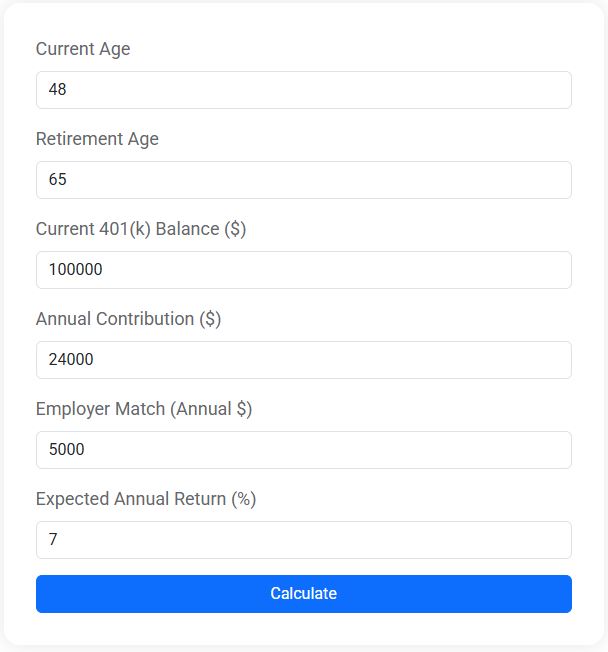

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Financing Your Real Estate Investment

Securing the right financing is a critical step in your real estate investment journey. Traditional mortgage loans are the most common financing option, especially for residential properties. However, they often require a significant down payment and a good credit score. Exploring options like FHA loans could be beneficial for beginners, as they offer lower down payment requirements.

For those interested in commercial properties, loans can be more complex and might require a higher down payment, often around 20% or more. Some investors opt for partnerships or crowdfunding platforms to raise capital. According to financial advisor Jane Smith, "Creative financing can open doors to investment opportunities that might otherwise seem out of reach. It's all about finding the right fit for your financial situation and investment goals."

Effective Property Management

Owning real estate is just the beginning; managing it effectively is where the real work begins. Whether you choose to self-manage or hire a property management company, staying on top of maintenance, tenant relations, and rent collection is crucial. Self-management can save you money, but it requires time and a willingness to handle everything from minor repairs to tenant disputes.

Alternatively, hiring a property management firm can relieve you of day-to-day responsibilities, though it comes at a cost—typically around 8-12% of rental income. As one seasoned investor puts it, "A good property manager is worth their weight in gold, freeing you to focus on growing your portfolio rather than managing it."

Balancing Risks and Rewards

Like any investment, real estate comes with its risks. Market fluctuations, unexpected repairs, and tenant turnover are a few challenges that investors might face. However, the potential rewards often outweigh these risks when approached with due diligence and a strategic mindset.

Diversification is a key strategy to mitigate risk. Instead of putting all your resources into a single property, consider spreading your investments across different types or locations. This way, if one market experiences a downturn, your entire portfolio isn't adversely affected. As Warren Buffett famously advises, "Never depend on a single income. Make investment to create a second source."

Real-World Examples and Success Stories

To illustrate the potential of real estate investing, consider the story of John, a school teacher who began investing in real estate with just enough savings to purchase a small duplex. By living in one unit and renting out the other, John covered most of his mortgage while gradually building equity. Over time, he reinvested his earnings to acquire additional properties, eventually transitioning from teaching to managing his real estate portfolio full-time.

Stories like John's highlight the transformative power of real estate investing. While not every journey will mirror his exactly, the principles of starting small, reinvesting profits, and learning continuously remain universal.

Conclusion: Your Next Steps

Embarking on a real estate investment journey requires education, patience, and a willingness to take calculated risks. By understanding the different types of real estate, conducting thorough market research, securing appropriate financing, and managing properties effectively, you can navigate the world of real estate with confidence.

Remember, real estate offers the potential for both financial growth and passive income, but success doesn't happen overnight. It's a marathon, not a sprint. Equip yourself with knowledge, stay informed about market trends, and don't be afraid to seek advice from seasoned investors. With these tools in your arsenal, you're well on your way to building a successful real estate investment portfolio.