Navigating Market Volatility: Tips for Keeping Your Investments on Track

Market volatility can be unsettling, but understanding its nature and focusing on long-term investment goals can help you navigate these fluctuations effectively. Key strategies include diversifying your portfolio, maintaining a cash reserve, and consulting with a financial advisor, which together help minimize potential losses and position your investments for future growth. Patience and discipline remain crucial in weathering the ups and downs of the market.

Market volatility. Just hearing those words might make you want to stash your investments under a metaphorical mattress until the storm passes. But before you go off-grid with your portfolio, let's talk about why volatility isn't necessarily the villain it’s often made out to be. While the market's ups and downs can be unsettling, they are also a normal, even healthy, part of economic cycles. The trick is to not just survive these turbulent times, but to navigate them with a smart strategy that keeps your long-term financial goals in sight.

Understanding the dynamics of market volatility can take some of the fear out of investing. Volatility, in essence, reflects the rate at which the price of investments increases or decreases for a given set of returns. It's the heartbeat of the market, and just like any heartbeat, a certain rhythm is normal. However, when the market experiences higher-than-usual volatility, it can feel like a wild ride. Knowing how to hold steady during these times is crucial, and that's what this article is all about. Let’s dive into some practical strategies that can help you keep your investments on track, even when the market gets a bit tumultuous.

Diversify Your Portfolio

Diversification is the golden rule of investing, and for good reason. It’s not just about spreading your money across different stocks; it’s about balancing your portfolio with a mix of asset types that react differently to market events. For instance, when technology stocks see a downturn, commodities or bonds might hold steady or even rise. This is the essence of diversification – reducing risk by not putting all your financial eggs in one basket.

Consider the scenario of 2008, when the financial crisis hit. Many who had heavily invested in banking stocks saw their portfolios crumble. However, those who had diversified with commodities like gold or sectors like healthcare experienced less severe impacts. According to investment expert John Doe, "A well-diversified portfolio can act like a shock absorber during times of market turbulence." By spreading your investments across various sectors, geographical regions, and asset classes, you can cushion the impact of volatility and position yourself for smoother returns over time.

Maintain a Cash Reserve

Having a cash reserve is like having an emergency fund for your investments. It's a buffer that allows you to ride out market downturns without having to liquidate your assets at a loss. Think of it as your financial safety net. This reserve can cover unexpected expenses or provide liquidity when opportunities arise, without the need to sell investments at an inopportune time.

Imagine you're an investor during a market dip. Without a cash reserve, the pressure to sell assets to cover expenses can be immense. However, by maintaining a cash reserve, you give yourself the flexibility to wait for the market to recover, potentially saving you from realizing losses. Financial planner Jane Smith often advises her clients to keep at least three to six months' worth of living expenses in cash. This may vary depending on your individual financial situation, but the underlying principle remains the same: cash provides options and peace of mind.

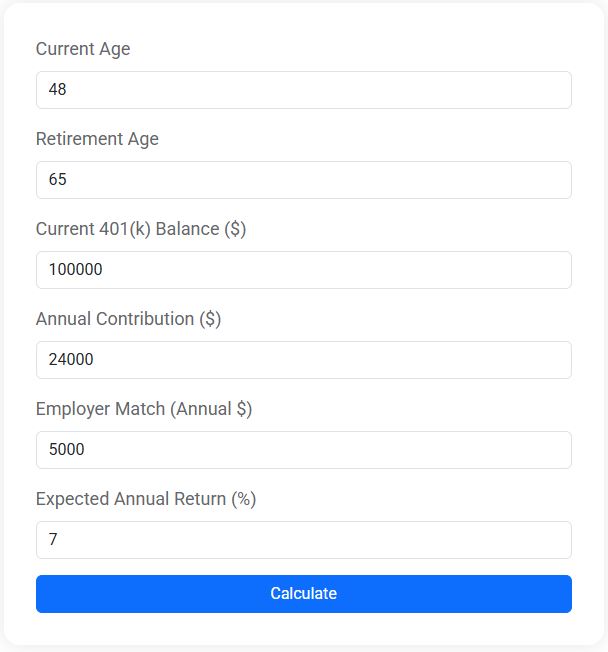

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Consult with a Financial Advisor

Navigating market volatility can feel daunting, especially if you're going it alone. A financial advisor can be your compass, guiding you through the complex landscape of investing with expert insight and personalized strategies. They can help you assess your risk tolerance, align your investments with your long-term goals, and make informed decisions during turbulent times.

Financial advisors bring more than just expertise; they offer an objective perspective that can be invaluable when emotions run high. According to a study by Vanguard, investors who work with a financial advisor can potentially increase their returns by about 3% annually through strategic guidance and behavioral coaching. So, if you find yourself panicking every time the market dips, it might be time to bring in a professional who can help keep those emotions in check and your investment plan on course.

Focus on Long-term Goals

When the market enters a phase of heightened volatility, it’s easy to get caught up in short-term noise. However, successful investing is more of a marathon than a sprint. Keeping your eyes on the prize—your long-term goals—can help you avoid making impulsive decisions based on temporary market swings.

Consider the story of Sarah, a long-term investor who stuck with her investment strategy through the 2008 financial crisis. While friends and family were selling off their stocks in a panic, Sarah reminded herself of her 20-year retirement plan. A decade later, her patience paid off as her portfolio not only recovered but also grew beyond her expectations. Her story underscores the importance of staying committed to your goals, even when the market tests your resolve.

Practice Patience and Discipline

In the world of investing, patience and discipline can be your greatest allies. These virtues help you stick to your investment plan and avoid the temptation to make rash decisions during volatile periods. It's about resisting the urge to "time the market" and instead focusing on "time in the market."

Warren Buffett, one of the most successful investors of all time, famously said, "The stock market is designed to transfer money from the Active to the Patient." His philosophy emphasizes the power of patience in achieving consistent investment returns. By staying disciplined and not reacting to every market fluctuation, you give your investments the time they need to grow and compound, which is the true key to building wealth over the long haul.

Conclusion

Market volatility may never fully disappear, but with the right strategies, you can navigate it effectively and keep your investments on track. Diversifying your portfolio, maintaining a cash reserve, consulting with a financial advisor, focusing on long-term goals, and practicing patience and discipline are all crucial components of a solid investment strategy. Remember, the market's ups and downs are natural, but how you respond makes all the difference. By staying informed and prepared, you can weather the financial storms and position your investments for future growth.