Investing in Your Future: Strategies for Millennials and Gen Z

Millennials and Gen Z face financial challenges like student loan debt and rising living costs, but investing can help build a stable financial foundation. Starting early, understanding investment basics, setting clear financial goals, diversifying investments, and leveraging technology are crucial strategies for long-term wealth-building. Maintaining financial discipline and patience is essential, as successful investing relies on consistent contributions and a long-term perspective.

Millennials and Gen Z are navigating a financial landscape that's vastly different from the one their parents faced. With challenges like mounting student loan debt, soaring housing prices, and a rapidly changing job market, securing a stable financial future can seem daunting. However, investing is a powerful tool that can help these generations build wealth and achieve financial independence. By starting early and adopting smart strategies, young investors can take advantage of the time on their side to grow their wealth and meet their financial goals.

Investing doesn't have to be intimidating. Whether you're just starting out or looking to refine your approach, understanding investment basics, setting clear goals, diversifying your portfolio, and leveraging technology can set you on the path to success. Let's dive into some strategies that can help Millennials and Gen Z navigate the world of investing with confidence and build a solid financial foundation.

Understanding Investment Basics

Before diving into the stock market or any other investment vehicle, it's crucial to grasp the fundamentals. At its core, investing is about putting your money to work with the expectation of generating a return over time. This can be achieved through various asset classes, such as stocks, bonds, real estate, or mutual funds. Each has its own level of risk and potential reward, so understanding these differences is key to making informed decisions.

Investing is not just about picking stocks; it's about understanding the market dynamics and how different factors, such as interest rates and economic indicators, can impact your investments. For instance, when interest rates rise, bond prices typically fall, which could affect your portfolio's value. Educating yourself on these basics can help you make better investment choices and avoid common pitfalls.

Moreover, the concept of compound interest is a game-changer. As Albert Einstein allegedly said, "Compound interest is the eighth wonder of the world." By reinvesting your earnings, your investments can grow exponentially over time, highlighting the importance of starting early. A solid grasp of these concepts can empower you to take control of your financial future.

Setting Clear Financial Goals

Investing without a plan is like driving without a destination. Setting clear financial goals is essential to guide your investment strategy and measure your progress. Whether you're saving for a down payment on a house, planning for a child's education, or aiming for early retirement, having specific objectives will help you tailor your investment approach.

Start by identifying your short-term and long-term goals. Short-term goals might include saving for a vacation or building an emergency fund, while long-term goals could involve retirement planning or purchasing a home. Once you've outlined your goals, determine your time horizon and risk tolerance, as these factors will influence your investment choices.

Consider breaking down your goals into actionable steps. For example, if you aim to retire by age 60 with a million-dollar nest egg, calculate how much you need to save and invest each month to reach that target. This clear roadmap will not only keep you motivated but also provide a framework for adjusting your strategy as your circumstances change.

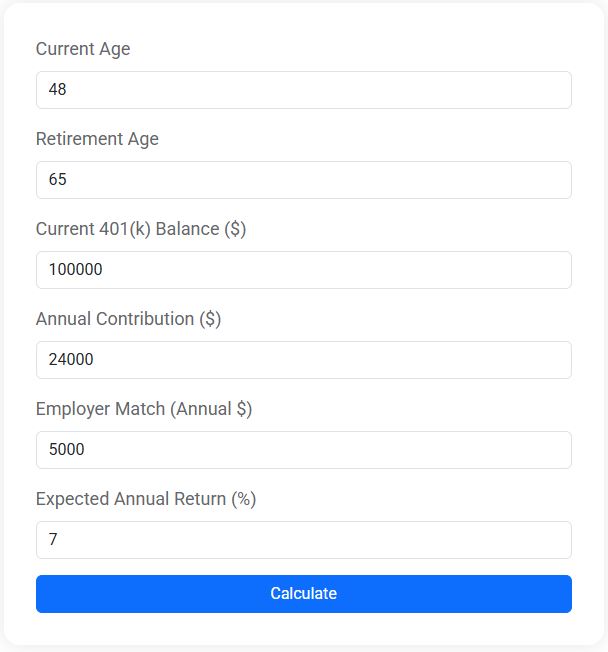

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Diversifying Your Investments

"Diversification is the only free lunch in investing," as the old adage goes, and for good reason. By spreading your investments across various asset classes and sectors, you can reduce risk and increase your chances of achieving consistent returns. Diversification ensures that when one investment underperforms, others may compensate, stabilizing your overall portfolio.

For instance, if you invest solely in tech stocks, a downturn in that sector could significantly impact your portfolio's value. Instead, consider allocating funds to different industries, such as healthcare, consumer goods, and energy, to mitigate risk. Similarly, including bonds or real estate in your portfolio can provide stability during market volatility.

Exchange-traded funds (ETFs) and mutual funds are excellent tools for diversification, as they allow you to invest in a basket of assets with a single purchase. This can be especially beneficial for young investors with limited capital. As financial advisor Jane Smith explains, "Diversification doesn't guarantee profits, but it does provide a cushion against the market's ups and downs."

Leveraging Technology

In today's digital age, technology offers unprecedented opportunities for investors. Millennials and Gen Z are particularly well-positioned to take advantage of these tools, from robo-advisors to investment apps that simplify the process and make investing more accessible than ever before.

Robo-advisors, like Betterment and Wealthfront, use algorithms to create and manage a diversified portfolio based on your financial goals and risk tolerance. They offer a low-cost alternative to traditional financial advisors, making them ideal for those just starting out. As CNBC notes, these platforms have democratized investing, allowing anyone with a smartphone to begin building wealth.

Additionally, investment apps like Robinhood and Acorns provide user-friendly interfaces and enable micro-investing, where you can invest small amounts, such as spare change, into a diversified portfolio. This can be an excellent way to start investing with little money and build good financial habits over time.

Maintaining Financial Discipline and Patience

Successful investing requires discipline and a long-term perspective. It's easy to get caught up in the excitement of market trends or react emotionally to market fluctuations, but maintaining a steady course is crucial for long-term success. As Warren Buffett famously said, "The stock market is designed to transfer money from the Active to the Patient."

One way to maintain discipline is through dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach reduces the impact of market volatility and helps you avoid the temptation to time the market, which can be a risky endeavor.

Additionally, regularly reviewing your investment portfolio and rebalancing as necessary can help ensure your asset allocation aligns with your goals and risk tolerance. It's important to stay informed about market developments, but remember that investing is a marathon, not a sprint. Patience and a long-term outlook can help you weather market storms and achieve your financial objectives.

In the end, investing is a powerful tool for Millennials and Gen Z to overcome financial challenges and build a secure future. By understanding investment basics, setting clear goals, diversifying, leveraging technology, and maintaining discipline, young investors can create a robust financial foundation. Embrace these strategies, and you'll be well on your way to achieving financial independence and prosperity.