Building Wealth Through Dividend Investing: Creating a Passive Income Stream

Dividend investing is a popular strategy for building wealth by purchasing stocks from companies that regularly pay out dividends, offering a steady income stream and potentially high returns over time. This approach involves selecting companies with strong fundamentals and a history of consistent payouts, while also reinvesting dividends to leverage compounding growth. Though it offers significant benefits, such as tax advantages and portfolio growth, it's crucial to manage risks through diversification and maintain a long-term perspective.

Dividend investing is a bit like planting a tree that, over time, will bear fruit in the form of regular income. This strategy is not just for the wealthy or financial wizards; it’s accessible to anyone with a bit of patience and a keen eye for detail. By purchasing stocks of companies that consistently pay dividends, investors can enjoy a steady stream of income and potentially see their wealth grow significantly over the years.

The appeal of dividend investing lies in its potential to create a passive income stream while also benefiting from the magic of compounding. Reinvesting dividends can lead to exponential growth in your portfolio, especially if you select companies with strong financial health and a history of reliable payouts. But like any investment strategy, it’s not without risks, and it requires a thoughtful approach to maximize its advantages.

Understanding Dividend Investing

Dividend investing involves buying shares of companies that return a portion of their profits to shareholders in the form of dividends. This approach can be particularly appealing to those looking for income without the need to sell shares. Companies that pay dividends are often well-established with predictable profits, making them a relatively stable investment option. For example, giants like Procter & Gamble and Coca-Cola are known for their reliable dividend payouts.

The key to successful dividend investing is in selecting stocks that not only pay dividends but also have a strong track record of maintaining or increasing these payments over time. This requires looking at a company’s financial statements, understanding its business model, and evaluating its ability to generate cash flow. The Dividend Aristocrats, a group of S&P 500 companies that have increased their dividends for 25 consecutive years, are often a good starting point for investors seeking reliability.

The Power of Compounding

One of the greatest benefits of dividend investing is the effect of compounding. When you reinvest your dividends, you purchase more shares, and over time, this can lead to exponential growth in your investment portfolio. It’s like a snowball rolling down a hill, gathering more snow and growing larger as it goes. Albert Einstein famously called compound interest the "eighth wonder of the world," and for good reason.

Consider this: if you invest $10,000 in a dividend stock yielding 4% annually and reinvest those dividends, your investment could grow to nearly $22,000 in 18 years, assuming the dividend yield and stock price remain constant. This example illustrates the potential for your money to work harder for you, generating returns on both your initial investment and the dividends it earns.

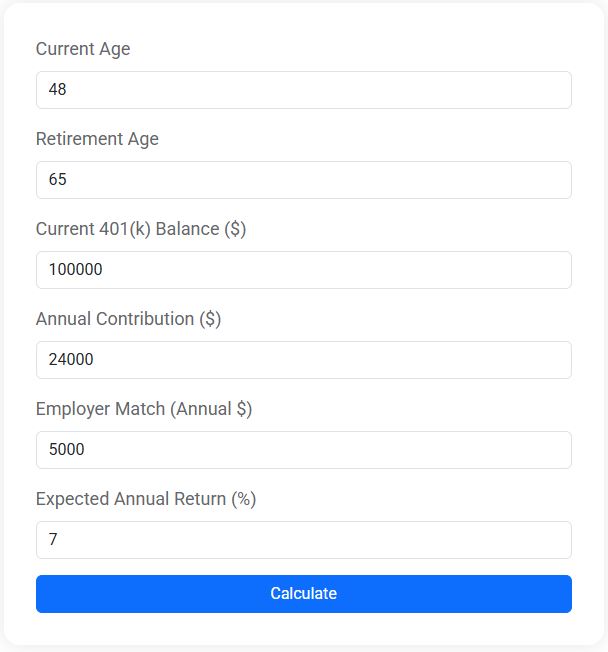

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Advantages of Dividend Investing

Dividend investing offers several notable benefits. First, it provides a passive income stream, which can be particularly attractive for retirees or anyone looking to supplement their income without selling their investments. This steady cash flow can also help cushion the blow during market downturns, as dividends tend to be less volatile than stock prices.

Another advantage is the potential for tax breaks. In many regions, qualified dividends are taxed at a lower rate than ordinary income, which can result in significant savings for investors. Additionally, dividend-paying stocks can contribute to portfolio growth, as companies that regularly distribute dividends often exhibit strong financial health and stability.

Furthermore, dividend investing encourages a long-term perspective. Because dividends are typically paid quarterly, investors are more likely to hold onto these stocks, fostering a buy-and-hold mentality that can lead to greater wealth accumulation over time.

Risks and Challenges

While the benefits are compelling, dividend investing is not without its challenges. One of the primary risks is the potential for dividend cuts. If a company faces financial difficulties, it may reduce or eliminate its dividend payments, impacting investors' income. This underscores the importance of thorough research and diversification to mitigate such risks.

Market fluctuations can also affect the value of dividend stocks. Although these companies tend to be less volatile, they are not immune to market downturns. Investors must be prepared for potential price declines and maintain a long-term perspective to ride out the storms.

Moreover, focusing solely on high-yield stocks can be a trap. High yields may indicate underlying issues within the company, such as financial instability or declining business prospects. It's crucial to evaluate the sustainability of dividend payments and not be swayed solely by attractive yields.

Diversification: A Key Strategy

Diversification is a cornerstone of any successful investment strategy, and dividend investing is no exception. By spreading investments across different sectors and industries, investors can reduce the impact of a poor performer on their overall portfolio. For instance, holding dividend stocks in sectors such as consumer goods, healthcare, and utilities can provide a balanced mix of stability and growth potential.

As financial advisor Jane Smith suggests, “Think of diversification as insurance for your portfolio. It doesn’t eliminate risk, but it does help manage it.” By not putting all your eggs in one basket, you can better withstand economic shifts and sector-specific challenges.

Building Your Dividend Portfolio

Creating a dividend portfolio involves selecting a mix of individual stocks and dividend-focused funds that align with your financial goals and risk tolerance. Start by identifying companies with strong financials, manageable debt levels, and a history of consistent dividend payments. It’s also wise to consider the company’s payout ratio, which indicates the proportion of earnings paid out as dividends. A lower payout ratio may suggest room for future growth.

According to CNBC, using dividend-focused exchange-traded funds (ETFs) or mutual funds can simplify the process for those who prefer a more hands-off approach. These funds offer instant diversification and professional management, making them an attractive option for new investors.

Maintaining a Long-Term Perspective

Patience is a virtue in dividend investing. Building wealth through this strategy doesn’t happen overnight, and it requires a long-term commitment. Staying focused on your goals and resisting the urge to react to short-term market volatility is essential for success.

As legendary investor Warren Buffett famously advises, “The stock market is designed to transfer money from the Active to the Patient.” Keeping a steady course, reinvesting dividends, and allowing your investments to compound over time can lead to substantial wealth accumulation.

In conclusion, dividend investing is a powerful strategy for building wealth and creating a passive income stream. By selecting quality companies, reinvesting dividends, and maintaining a diversified portfolio, investors can enjoy the benefits of compounding growth and financial stability. While it requires diligence and a long-term outlook, the rewards can be significant, paving the way for a more secure financial future.